Reset Form

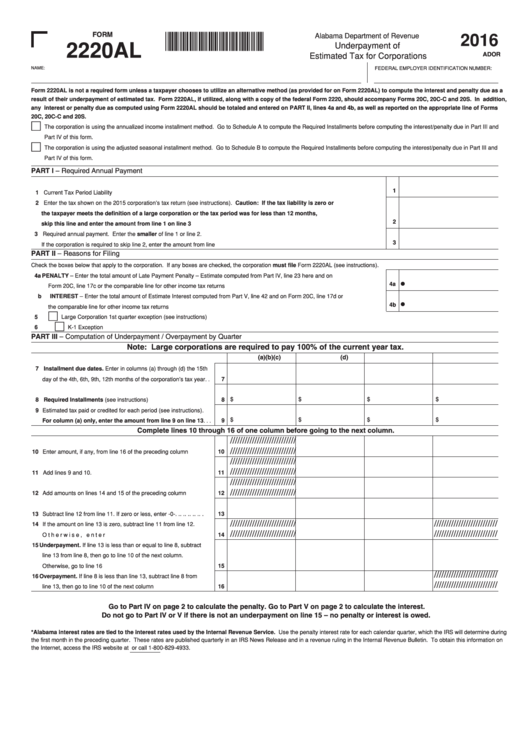

2016

FORM

1600122C

Alabama Department of Revenue

2220AL

Underpayment of

Estimated Tax for Corporations

ADOR

NAME:

FEDERAL EMPLOYER IDENTIFICATION NUMBER:

Form 2220AL is not a required form unless a taxpayer chooses to utilize an alternative method (as provided for on Form 2220AL) to compute the interest and penalty due as a

result of their underpayment of estimated tax. Form 2220AL, if utilized, along with a copy of the federal Form 2220, should accompany Forms 20C, 20C-C and 20S. In addition,

any interest or penalty due as computed using Form 2220AL should be totaled and entered on PART II, lines 4a and 4b, as well as reported on the appropriate line of Forms

20C, 20C-C and 20S.

The corporation is using the annualized income installment method. Go to Schedule A to compute the Required Installments before computing the interest/penalty due in Part III and

Part IV of this form.

The corporation is using the adjusted seasonal installment method. Go to Schedule B to compute the Required Installments before computing the interest/penalty due in Part III and

Part IV of this form.

PART I – Required Annual Payment

1

1 Current Tax Period Liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Enter the tax shown on the 2015 corporation’s tax return (see instructions). Caution: If the tax liability is zero or

the taxpayer meets the definition of a large corporation or the tax period was for less than 12 months,

2

skip this line and enter the amount from line 1 on line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Required annual payment. Enter the smaller of line 1 or line 2.

3

If the corporation is required to skip line 2, enter the amount from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART II – Reasons for Filing

Check the boxes below that apply to the corporation. If any boxes are checked, the corporation must file Form 2220AL (see instructions).

4a

PENALTY – Enter the total amount of Late Payment Penalty – Estimate computed from Part IV, line 23 here and on

•

4a

Form 20C, line 17c or the comparable line for other income tax returns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b INTEREST – Enter the total amount of Estimate Interest computed from Part V, line 42 and on Form 20C, line 17d or

•

4b

the comparable line for other income tax returns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Large Corporation 1st quarter exception (see instructions)

6

K-1 Exception

PART III – Computation of Underpayment / Overpayment by Quarter

Note: Large corporations are required to pay 100% of the current year tax.

(a)

(b)

(c)

(d)

7 Installment due dates. Enter in columns (a) through (d) the 15th

day of the 4th, 6th, 9th, 12th months of the corporation’s tax year . .

7

$

$

$

$

8 Required Installments (see instructions). . . . . . . . . . . . . . . . . . . . . .

8

9 Estimated tax paid or credited for each period (see instructions).

$

$

$

$

For column (a) only, enter the amount from line 9 on line 13 . . .

9

Complete lines 10 through 16 of one column before going to the next column.

///////////////////////////

///////////////////////////

10 Enter amount, if any, from line 16 of the preceding column. . . . . . . .

10

///////////////////////////

///////////////////////////

11

11 Add lines 9 and 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

///////////////////////////

///////////////////////////

12 Add amounts on lines 14 and 15 of the preceding column . . . . . . . .

12

13 Subtract line 12 from line 11. If zero or less, enter -0- . . . . . . . . . . . .

13

///////////////////////////

//////////////////////////

14 If the amount on line 13 is zero, subtract line 11 from line 12.

///////////////////////////

//////////////////////////

Otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Underpayment. If line 13 is less than or equal to line 8, subtract

line 13 from line 8, then go to line 10 of the next column.

Otherwise, go to line 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

//////////////////////////

16 Overpayment. If line 8 is less than line 13, subtract line 8 from

//////////////////////////

line 13, then go to line 10 of the next column . . . . . . . . . . . . . . . . . . .

16

Go to Part IV on page 2 to calculate the penalty. Go to Part V on page 2 to calculate the interest.

Do not go to Part IV or V if there is not an underpayment on line 15 – no penalty or interest is owed.

*Alabama interest rates are tied to the interest rates used by the Internal Revenue Service. Use the penalty interest rate for each calendar quarter, which the IRS will determine during

the first month in the preceding quarter. These rates are published quarterly in an IRS News Release and in a revenue ruling in the Internal Revenue Bulletin. To obtain this information on

the Internet, access the IRS website at or call 1-800-829-4933.

1

1 2

2 3

3 4

4 5

5