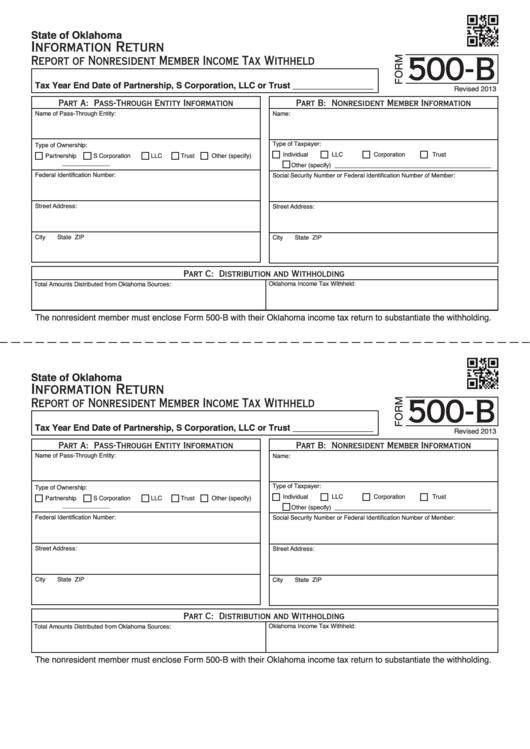

State of Oklahoma

Information Return

500-B

Report of Nonresident Member Income Tax Withheld

Tax Year End Date of Partnership, S Corporation, LLC or Trust _________________

Revised 2013

Part A: Pass-Through Entity Information

Part B: Nonresident Member Information

Name of Pass-Through Entity:

Name:

Type of Taxpayer:

Type of Ownership:

Individual

LLC

Corporation

Trust

Partnership

S Corporation

LLC

Trust

Other (specify)

______________

Other (specify) ______________________________________________

Federal Identification Number:

Social Security Number or Federal Identification Number of Member:

Street Address:

Street Address:

City

State

ZIP

City

State

ZIP

Part C: Distribution and Withholding

Oklahoma Income Tax Withheld:

Total Amounts Distributed from Oklahoma Sources:

The nonresident member must enclose Form 500-B with their Oklahoma income tax return to substantiate the withholding.

State of Oklahoma

Information Return

500-B

Report of Nonresident Member Income Tax Withheld

Tax Year End Date of Partnership, S Corporation, LLC or Trust _________________

Revised 2013

Part A: Pass-Through Entity Information

Part B: Nonresident Member Information

Name of Pass-Through Entity:

Name:

Type of Taxpayer:

Type of Ownership:

Individual

LLC

Corporation

Trust

Partnership

S Corporation

LLC

Trust

Other (specify)

______________

Other (specify) ______________________________________________

Federal Identification Number:

Social Security Number or Federal Identification Number of Member:

Street Address:

Street Address:

City

State

ZIP

City

State

ZIP

Part C: Distribution and Withholding

Oklahoma Income Tax Withheld:

Total Amounts Distributed from Oklahoma Sources:

The nonresident member must enclose Form 500-B with their Oklahoma income tax return to substantiate the withholding.

1

1