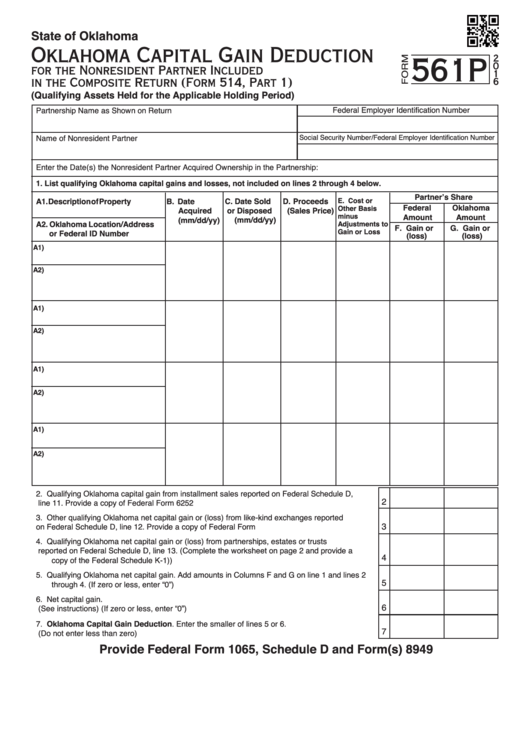

State of Oklahoma

Oklahoma Capital Gain Deduction

561P

2

0

for the Nonresident Partner Included

1

in the Composite Return (Form 514, Part 1)

6

(Qualifying Assets Held for the Applicable Holding Period)

Federal Employer Identification Number

Partnership Name as Shown on Return

Name of Nonresident Partner

Social Security Number/Federal Employer Identification Number

Enter the Date(s) the Nonresident Partner Acquired Ownership in the Partnership:

1. List qualifying Oklahoma capital gains and losses, not included on lines 2 through 4 below.

Partner’s Share

C. Date Sold

D. Proceeds

E. Cost or

A1. Description of Property

B. Date

Federal

Oklahoma

Other Basis

Acquired

or Disposed

(Sales Price)

minus

Amount

Amount

(mm/dd/yy)

(mm/dd/yy)

A2. Oklahoma Location/Address

Adjustments to

F. Gain or

G. Gain or

Gain or Loss

or Federal ID Number

(loss)

(loss)

A1)

A2)

A1)

A2)

A1)

A2)

A1)

A2)

2.

Qualifying Oklahoma capital gain from installment sales reported on Federal Schedule D,

2

line 11. Provide a copy of Federal Form 6252 ..............................................................................

3.

Other qualifying Oklahoma net capital gain or (loss) from like-kind exchanges reported

3

on Federal Schedule D, line 12. Provide a copy of Federal Form 8824.......................................

4.

Qualifying Oklahoma net capital gain or (loss) from partnerships, estates or trusts

reported on Federal Schedule D, line 13. (Complete the worksheet on page 2 and provide a

4

copy of the Federal Schedule K-1))..............................................................................................

5.

Qualifying Oklahoma net capital gain. Add amounts in Columns F and G on line 1 and lines 2

5

through 4. (If zero or less, enter “0”).............................................................................................

6.

Net capital gain.

6

(See instructions) (If zero or less, enter “0”) .................................................................................

7.

Oklahoma Capital Gain Deduction. Enter the smaller of lines 5 or 6.

7

(Do not enter less than zero) ........................................................................................................

Provide Federal Form 1065, Schedule D and Form(s) 8949

1

1 2

2