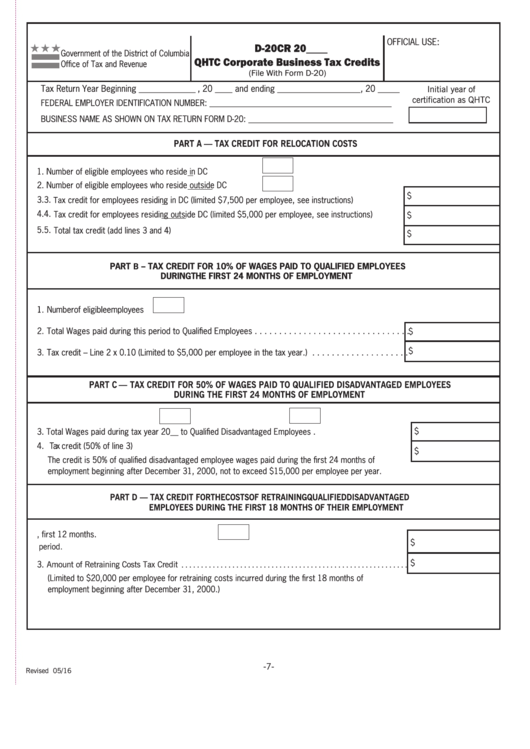

Form D-20cr - Qhtc Corporate Business Tax Credits

ADVERTISEMENT

OFFICIAL USE:

D-20CR 20____

Government of the District of Columbia

QHTC Corporate Business Tax Credits

Office of Tax and Revenue

(File With Form D-20)

Tax Return Year Beginning _____________ , 20 ____ and ending ___________________ , 20 _____

Initial year of

certification as QHTC

FEDERAL EMPLOYER IDENTIFICATION NUMBER: ____________________________________________

BUSINESS NAME AS SHOWN ON TAX RETURN FORM D-20: ___________________________________

PART A — TAX CREDIT FOR RELOCATION COSTS

1. Number of eligible employees who reside in DC

2. Number of eligible employees who reside outside DC

$

3. 3. Tax credit for employees residing in DC (limited $7,500 per employee, see instructions) .........................

4. 4. Tax credit for employees residing outside DC (limited $5,000 per employee, see instructions) .................

$

5. 5. Total tax credit (add lines 3 and 4) .......................................................................................................

$

PART B – TAX CREDIT FOR 10% OF WAGES PAID TO QUALIFIED EMPLOYEES

DURING THE FIRST 24 MONTHS OF EMPLOYMENT

1. Number of eligible employees

2. Total Wages paid during this period to Qualified Employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

3. Tax credit – Line 2 x 0.10 (Limited to $5,000 per employee in the tax year.) . . . . . . . . . . . . . . . . . . . .

PART C — TAX CREDIT FOR 50% OF WAGES PAID TO QUALIFIED DISADVANTAGED EMPLOYEES

DURING THE FIRST 24 MONTHS OF EMPLOYMENT

1. Employees eligible in First year

2. Months in First year

3. Total Wages paid during tax year 20__ to Qualified Disadvantaged Employees ........................................

$

4. Tax credit (50% of line 3) ....................................................................................................................

$

The credit is 50% of qualified disadvantaged employee wages paid during the first 24 months of

employment beginning after December 31, 2000, not to exceed $15,000 per employee per year.

PART D — TAX CREDIT FOR THE COSTS OF RETRAINING QUALIFIED DISADVANTAGED

EMPLOYEES DURING THE FIRST 18 MONTHS OF THEIR EMPLOYMENT

1. Number of employees eligible, first 12 months.

$

2. Total expenditures for retraining Qualified Disadvantaged Employees paid or incurred during this period.

$

3.

Amount of Retraining Costs Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Limited to $20,000 per employee for retraining costs incurred during the first 18 months of

employment beginning after December 31, 2000.)

-7-

-7-

Revised 05/16

Revised 05/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3