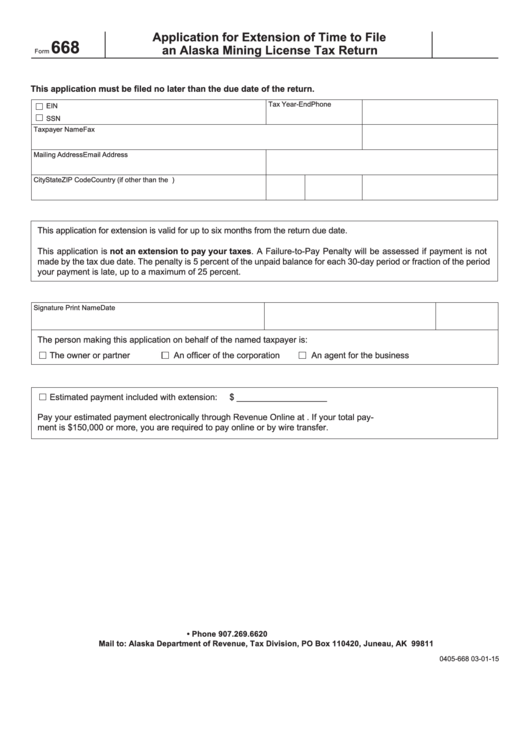

Form 668 - Application For Extension Of Time To File An Alaska Mining License Tax Return

ADVERTISEMENT

Application for Extension of Time to File

668

an Alaska Mining License Tax Return

Form

This application must be filed no later than the due date of the return.

Tax Year-End

Phone

EIN

SSN

Taxpayer Name

Fax

Mailing Address

Email Address

City

State

ZIP Code

Country (if other than the U.S.)

This application for extension is valid for up to six months from the return due date.

This application is not an extension to pay your taxes. A Failure-to-Pay Penalty will be assessed if payment is not

made by the tax due date. The penalty is 5 percent of the unpaid balance for each 30-day period or fraction of the period

your payment is late, up to a maximum of 25 percent.

Signature

Print Name

Date

The person making this application on behalf of the named taxpayer is:

The owner or partner

An officer of the corporation

An agent for the business

Estimated payment included with extension:

$ ___________________

Pay your estimated payment electronically through Revenue Online at If your total pay-

ment is $150,000 or more, you are required to pay online or by wire transfer.

• Phone 907.269.6620

Mail to: Alaska Department of Revenue, Tax Division, PO Box 110420, Juneau, AK 99811

0405-668 03-01-15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1