*0431000*

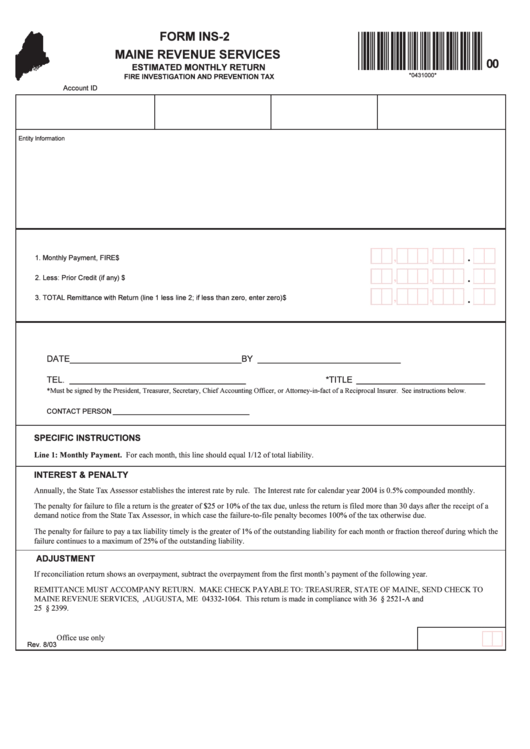

FORM INS-2

MAINE REVENUE SERVICES

00

ESTIMATED MONTHLY RETURN

*0431000*

FIRE INVESTIGATION AND PREVENTION TAX

Account ID No.

Period Begin

Period End

Due Date

Entity Information

,

,

.

1. Monthly Payment, FIRE

..................................................................................................................... 1. $

,

,

.

2. Less: Prior Credit (if any)

..................................................................................................................... 2. $

,

,

.

3. TOTAL Remittance with Return (line 1 less line 2; if less than zero, enter zero) ...................................... 3. $

DATE ____________________________________

BY ______________________________

TEL. _____________________________________

*TITLE ___________________________

*Must be signed by the President, Treasurer, Secretary, Chief Accounting Officer, or Attorney-in-fact of a Reciprocal Insurer. See instructions below.

CONTACT PERSON ___________________________________

SPECIFIC INSTRUCTIONS

Line 1: Monthly Payment. For each month, this line should equal 1/12 of total liability.

INTEREST & PENALTY

Annually, the State Tax Assessor establishes the interest rate by rule. The Interest rate for calendar year 2004 is 0.5% compounded monthly.

The penalty for failure to file a return is the greater of $25 or 10% of the tax due, unless the return is filed more than 30 days after the receipt of a

demand notice from the State Tax Assessor, in which case the failure-to-file penalty becomes 100% of the tax otherwise due.

The penalty for failure to pay a tax liability timely is the greater of 1% of the outstanding liability for each month or fraction thereof during which the

failure continues to a maximum of 25% of the outstanding liability.

ADJUSTMENT

If reconciliation return shows an overpayment, subtract the overpayment from the first month’s payment of the following year.

REMITTANCE MUST ACCOMPANY RETURN. MAKE CHECK PAYABLE TO: TREASURER, STATE OF MAINE, SEND CHECK TO

MAINE REVENUE SERVICES, P.O. BOX 1064, AUGUSTA, ME 04332-1064. This return is made in compliance with 36 M.R.S.A. § 2521-A and

25 M.R.S.A. § 2399.

Office use only

Rev. 8/03

1

1