Form 106-Ep - Composite Nonresident Return Estimated Tax Payment Voucher - 2004

ADVERTISEMENT

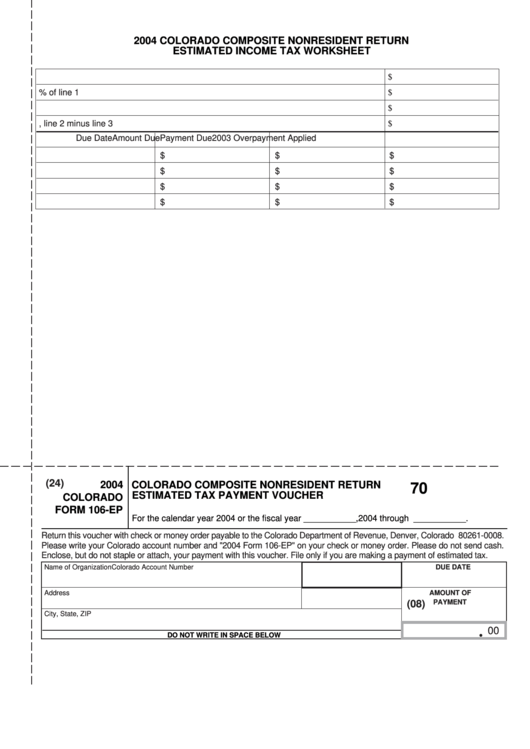

2004 COLORADO COMPOSITE NONRESIDENT RETURN

ESTIMATED INCOME TAX WORKSHEET

1.

Estimated 2004 Colorado taxable income

$

2.

Estimated 2004 Colorado income tax - 4.63% of line 1

$

3.

Estimated 2004 Form 106CR credits

$

4.

Net estimated tax, line 2 minus line 3

$

Due Date

Amount Due

2003 Overpayment Applied

Payment Due

$

$

$

$

$

$

$

$

$

$

$

$

(24)

2004

COLORADO COMPOSITE NONRESIDENT RETURN

70

ESTIMATED TAX PAYMENT VOUCHER

COLORADO

FORM 106-EP

For the calendar year 2004 or the fiscal year ___________,2004 through ___________.

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008.

Please write your Colorado account number and "2004 Form 106-EP" on your check or money order. Please do not send cash.

Enclose, but do not staple or attach, your payment with this voucher. File only if you are making a payment of estimated tax.

Name of Organization

Colorado Account Number

DUE DATE

AMOUNT OF

Address

F.E.I.N.

PAYMENT

(08)

City, State, ZIP

00

DO NOT WRITE IN SPACE BELOW

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2