Form Tc101ins - Application For Class Two Or Class Four Properties - 2009

ADVERTISEMENT

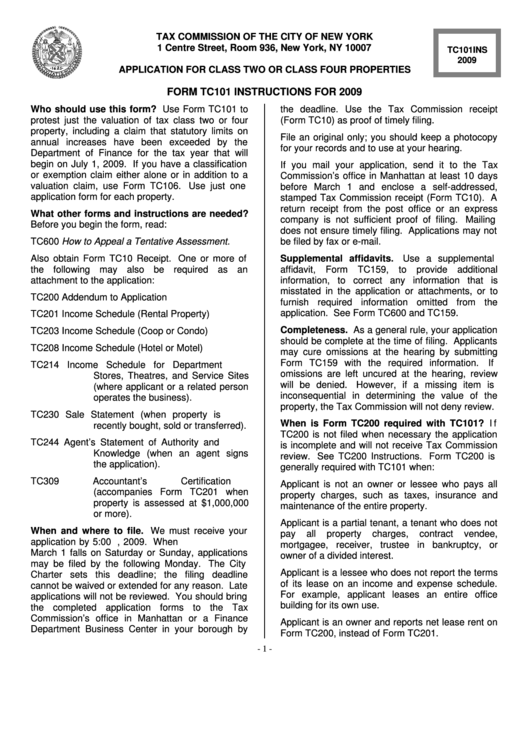

TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

TC101INS

2009

APPLICATION FOR CLASS TWO OR CLASS FOUR PROPERTIES

FORM TC101 INSTRUCTIONS FOR 2009

Who should use this form? Use Form TC101 to

the deadline. Use the Tax Commission receipt

protest just the valuation of tax class two or four

(Form TC10) as proof of timely filing.

property, including a claim that statutory limits on

File an original only; you should keep a photocopy

annual increases have been exceeded by the

for your records and to use at your hearing.

Department of Finance for the tax year that will

begin on July 1, 2009. If you have a classification

If you mail your application, send it to the Tax

or exemption claim either alone or in addition to a

Commission’s office in Manhattan at least 10 days

valuation claim, use Form TC106. Use just one

before March 1 and enclose a self-addressed,

application form for each property.

stamped Tax Commission receipt (Form TC10). A

return receipt from the post office or an express

What other forms and instructions are needed?

company is not sufficient proof of filing. Mailing

Before you begin the form, read:

does not ensure timely filing. Applications may not

TC600 How to Appeal a Tentative Assessment.

be filed by fax or e-mail.

Also obtain Form TC10 Receipt. One or more of

Supplemental affidavits.

Use a supplemental

the following may also be required as an

affidavit, Form TC159, to provide additional

attachment to the application:

information, to correct any information that is

misstated in the application or attachments, or to

TC200

Addendum to Application

furnish required information omitted from the

application. See Form TC600 and TC159.

TC201

Income Schedule (Rental Property)

Completeness. As a general rule, your application

TC203

Income Schedule (Coop or Condo)

should be complete at the time of filing. Applicants

TC208

Income Schedule (Hotel or Motel)

may cure omissions at the hearing by submitting

Form TC159 with the required information.

If

TC214

Income Schedule for Department

omissions are left uncured at the hearing, review

Stores, Theatres, and Service Sites

will be denied.

However, if a missing item is

(where applicant or a related person

inconsequential in determining the value of the

operates the business).

property, the Tax Commission will not deny review.

TC230

Sale Statement (when property is

When is Form TC200 required with TC101? If

recently bought, sold or transferred).

TC200 is not filed when necessary the application

TC244

Agent’s Statement of Authority and

is incomplete and will not receive Tax Commission

Knowledge (when an agent signs

review. See TC200 Instructions. Form TC200 is

the application).

generally required with TC101 when:

TC309

Accountant’s Certification

Applicant is not an owner or lessee who pays all

(accompanies Form TC201 when

property charges, such as taxes, insurance and

property is assessed at $1,000,000

maintenance of the entire property.

or more).

Applicant is a partial tenant, a tenant who does not

When and where to file. We must receive your

pay

all

property

charges,

contract

vendee,

application by 5:00 P.M. on March 2, 2009. When

mortgagee, receiver, trustee in bankruptcy, or

March 1 falls on Saturday or Sunday, applications

owner of a divided interest.

may be filed by the following Monday. The City

Applicant is a lessee who does not report the terms

Charter sets this deadline; the filing deadline

of its lease on an income and expense schedule.

cannot be waived or extended for any reason. Late

For example, applicant leases an entire office

applications will not be reviewed. You should bring

building for its own use.

the completed application forms to the Tax

Commission’s office in Manhattan or a Finance

Applicant is an owner and reports net lease rent on

Department Business Center in your borough by

Form TC200, instead of Form TC201.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4