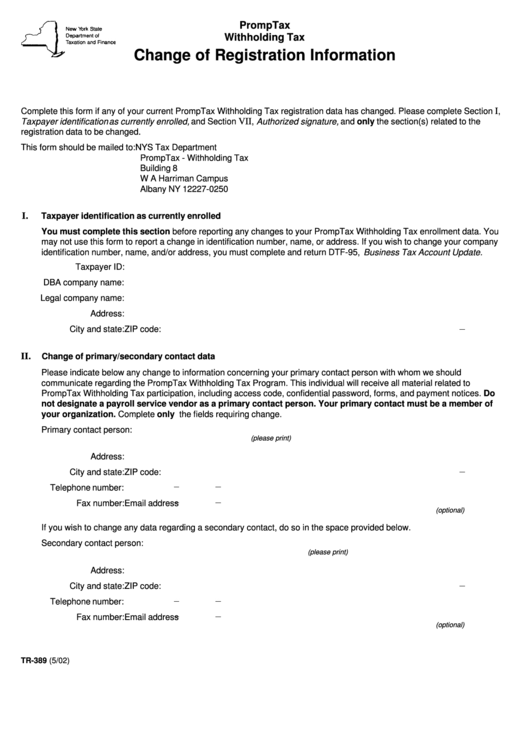

PrompTax

Withholding Tax

Change of Registration Information

I

Complete this form if any of your current PrompTax Withholding Tax registration data has changed. Please complete Section

,

Taxpayer identification as currently enrolled, and Section

VII

, Authorized signature, and only the section(s) related to the

registration data to be changed.

This form should be mailed to: NYS Tax Department

PrompTax - Withholding Tax

Building 8

W A Harriman Campus

Albany NY 12227-0250

I.

Taxpayer identification as currently enrolled

You must complete this section before reporting any changes to your PrompTax Withholding Tax enrollment data. You

may not use this form to report a change in identification number, name, or address. If you wish to change your company

identification number, name, and/or address, you must complete and return DTF-95, Business Tax Account Update.

Taxpayer ID:

DBA company name:

Legal company name:

Address:

City and state:

ZIP code:

II.

Change of primary/secondary contact data

Please indicate below any change to information concerning your primary contact person with whom we should

communicate regarding the PrompTax Withholding Tax Program. This individual will receive all material related to

PrompTax Withholding Tax participation, including access code, confidential password, forms, and payment notices. Do

not designate a payroll service vendor as a primary contact person. Your primary contact must be a member of

your organization. Complete only the fields requiring change.

Primary contact person:

(please print)

Address:

City and state:

ZIP code:

Telephone number:

Fax number:

Email address

(optional)

If you wish to change any data regarding a secondary contact, do so in the space provided below.

Secondary contact person:

(please print)

Address:

City and state:

ZIP code:

Telephone number:

Fax number:

Email address

(optional)

TR-389 (5/02)

1

1 2

2 3

3