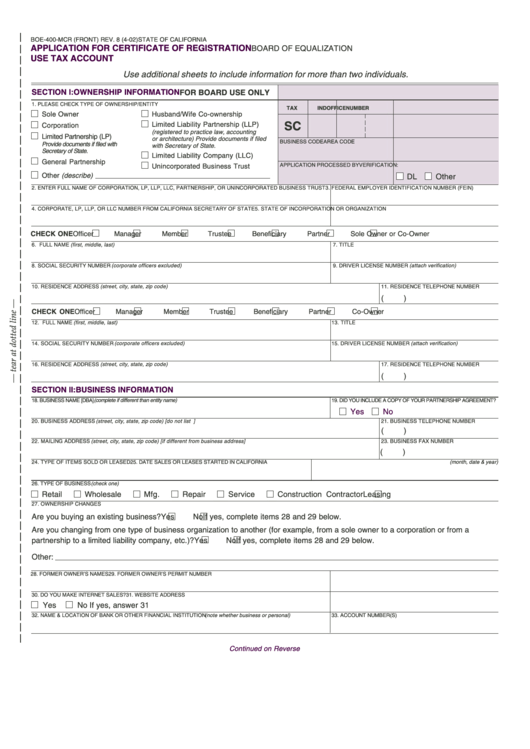

BOE-400-MCR (FRONT) REV. 8 (4-02)

STATE OF CALIFORNIA

APPLICATION FOR CERTIFICATE OF REGISTRATION

BOARD OF EQUALIZATION

USE TAX ACCOUNT

Use additional sheets to include information for more than two individuals.

SECTION I: OWNERSHIP INFORMATION

FOR BOARD USE ONLY

1. PLEASE CHECK TYPE OF OWNERSHIP/ENTITY

TAX

IND

OFFICE

NUMBER

Sole Owner

Husband/Wife Co-ownership

SC

Limited Liability Partnership (LLP)

Corporation

(registered to practice law, accounting

Limited Partnership (LP)

or architecture) Provide documents if filed

BUSINESS CODE

AREA CODE

Provide documents if filed with

with Secretary of State.

Secretary of State.

Limited Liability Company (LLC)

General Partnership

APPLICATION PROCESSED BY

VERIFICATION:

Unincorporated Business Trust

Other (describe)

DL

Other

2. ENTER FULL NAME OF CORPORATION, LP, LLP, LLC, PARTNERSHIP, OR UNINCORPORATED BUSINESS TRUST

3. FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN)

4. CORPORATE, LP, LLP, OR LLC NUMBER FROM CALIFORNIA SECRETARY OF STATE

5. STATE OF INCORPORATION OR ORGANIZATION

CHECK ONE

Officer

Manager

Member

Trustee

Beneficiary

Partner

Sole Owner or Co-Owner

6. FULL NAME (first, middle, last)

7. TITLE

8. SOCIAL SECURITY NUMBER (corporate officers excluded)

9. DRIVER LICENSE NUMBER (attach verification)

10. RESIDENCE ADDRESS (street, city, state, zip code)

11. RESIDENCE TELEPHONE NUMBER

(

)

CHECK ONE

Officer

Manager

Member

Trustee

Beneficiary

Partner

Co-Owner

12. FULL NAME (first, middle, last)

13. TITLE

14. SOCIAL SECURITY NUMBER (corporate officers excluded)

15. DRIVER LICENSE NUMBER (attach verification)

16. RESIDENCE ADDRESS (street, city, state, zip code)

17. RESIDENCE TELEPHONE NUMBER

(

)

SECTION II: BUSINESS INFORMATION

18. BUSINESS NAME [DBA] (complete if different than entity name)

19. DID YOU INCLUDE A COPY OF YOUR PARTNERSHIP AGREEMENT?

Yes

No

20. BUSINESS ADDRESS (street, city, state, zip code) [do not list P.O. Box or mailing service]

21. BUSINESS TELEPHONE NUMBER

(

)

22. MAILING ADDRESS (street, city, state, zip code) [if different from business address]

23. BUSINESS FAX NUMBER

(

)

24. TYPE OF ITEMS SOLD OR LEASED

25. DATE SALES OR LEASES STARTED IN CALIFORNIA (month, date & year)

26. TYPE OF BUSINESS (check one)

Retail

Wholesale

Mfg.

Repair

Service

Construction Contractor

Leasing

27. OWNERSHIP CHANGES

Are you buying an existing business?

Yes

No If yes, complete items 28 and 29 below.

Are you changing from one type of business organization to another (for example, from a sole owner to a corporation or from a

partnership to a limited liability company, etc.)?

Yes

No If yes, complete items 28 and 29 below.

Other:

28. FORMER OWNER’S NAMES

29. FORMER OWNER’S PERMIT NUMBER

30. DO YOU MAKE INTERNET SALES?

31. WEBSITE ADDRESS

Yes

No

If yes, answer 31

32. NAME & LOCATION OF BANK OR OTHER FINANCIAL INSTITUTION (note whether business or personal)

33. ACCOUNT NUMBER(S)

Continued on Reverse

1

1 2

2