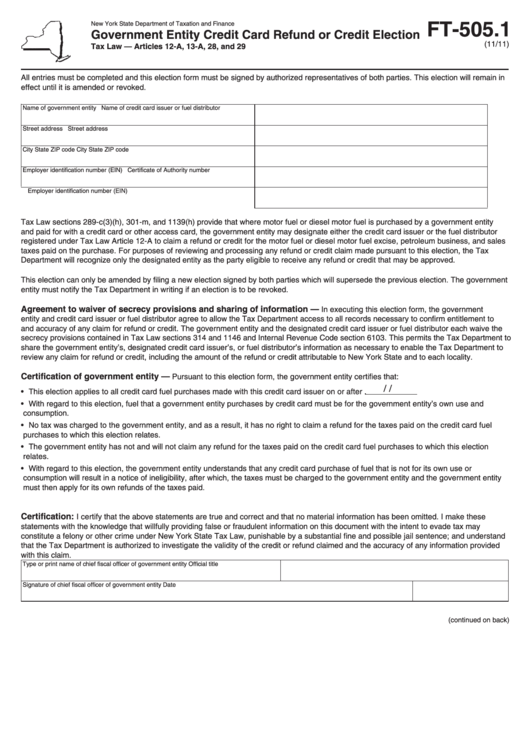

Form Ft-505.1 - Government Entity Credit Card Refund Or Credit Election

ADVERTISEMENT

FT‑505.1

New York State Department of Taxation and Finance

Government Entity Credit Card Refund or Credit Election

(11/11)

Tax Law — Articles 12‑A, 13‑A, 28, and 29

All entries must be completed and this election form must be signed by authorized representatives of both parties. This election will remain in

effect until it is amended or revoked.

Name of government entity

Name of credit card issuer or fuel distributor

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Employer identification number (EIN)

Certificate of Authority number

Employer identification number (EIN)

Tax Law sections 289-c(3)(h), 301-m, and 1139(h) provide that where motor fuel or diesel motor fuel is purchased by a government entity

and paid for with a credit card or other access card, the government entity may designate either the credit card issuer or the fuel distributor

registered under Tax Law Article 12-A to claim a refund or credit for the motor fuel or diesel motor fuel excise, petroleum business, and sales

taxes paid on the purchase. For purposes of reviewing and processing any refund or credit claim made pursuant to this election, the Tax

Department will recognize only the designated entity as the party eligible to receive any refund or credit that may be approved.

This election can only be amended by filing a new election signed by both parties which will supersede the previous election. The government

entity must notify the Tax Department in writing if an election is to be revoked.

Agreement to waiver of secrecy provisions and sharing of information —

In executing this election form, the government

entity and credit card issuer or fuel distributor agree to allow the Tax Department access to all records necessary to confirm entitlement to

and accuracy of any claim for refund or credit. The government entity and the designated credit card issuer or fuel distributor each waive the

secrecy provisions contained in Tax Law sections 314 and 1146 and Internal Revenue Code section 6103. This permits the Tax Department to

share the government entity’s, designated credit card issuer’s, or fuel distributor’s information as necessary to enable the Tax Department to

review any claim for refund or credit, including the amount of the refund or credit attributable to New York State and to each locality.

Certification of government entity —

Pursuant to this election form, the government entity certifies that:

/

/

• This election applies to all credit card fuel purchases made with this credit card issuer on or after

.

• With regard to this election, fuel that a government entity purchases by credit card must be for the government entity’s own use and

consumption.

• No tax was charged to the government entity, and as a result, it has no right to claim a refund for the taxes paid on the credit card fuel

purchases to which this election relates.

• The government entity has not and will not claim any refund for the taxes paid on the credit card fuel purchases to which this election

relates.

• With regard to this election, the government entity understands that any credit card purchase of fuel that is not for its own use or

consumption will result in a notice of ineligibility, after which, the taxes must be charged to the government entity and the government entity

must then apply for its own refunds of the taxes paid.

Certification:

I certify that the above statements are true and correct and that no material information has been omitted. I make these

statements with the knowledge that willfully providing false or fraudulent information on this document with the intent to evade tax may

constitute a felony or other crime under New York State Tax Law, punishable by a substantial fine and possible jail sentence; and understand

that the Tax Department is authorized to investigate the validity of the credit or refund claimed and the accuracy of any information provided

with this claim.

Type or print name of chief fiscal officer of government entity

Official title

Signature of chief fiscal officer of government entity

Date

(continued on back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2