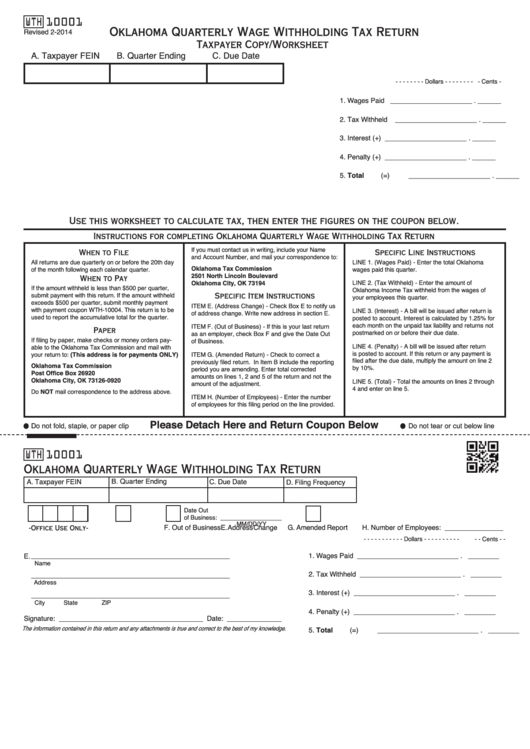

WTH 10001

Oklahoma Quarterly Wage Withholding Tax Return

Revised 2-2014

Taxpayer Copy/Worksheet

A. Taxpayer FEIN

B. Quarter Ending

C. Due Date

- - - - - - - - Dollars - - - - - - - -

- Cents -

1. Wages Paid

_____________________ . ______

2. Tax Withheld _____________________ . ______

3. Interest

(+) _____________________ . ______

4. Penalty

(+) _____________________ . ______

5. Total

(=) _____________________ . ______

Use this worksheet to calculate tax, then enter the figures on the coupon below.

Instructions for completing Oklahoma Quarterly Wage Withholding Tax Return

If you must contact us in writing, include your Name

When to File

Specific Line Instructions

and Account Number, and mail your correspondence to:

All returns are due quarterly on or before the 20th day

LINE 1. (Wages Paid) - Enter the total Oklahoma

Oklahoma Tax Commission

of the month following each calendar quarter.

wages paid this quarter.

2501 North Lincoln Boulevard

When to Pay

Oklahoma City, OK 73194

LINE 2. (Tax Withheld) - Enter the amount of

If the amount withheld is less than $500 per quarter,

Oklahoma Income Tax withheld from the wages of

submit payment with this return. If the amount withheld

Specific Item Instructions

your employees this quarter.

exceeds $500 per quarter, submit monthly payment

ITEM E. (Address Change) - Check Box E to notify us

with payment coupon WTH-10004. This return is to be

LINE 3. (Interest) - A bill will be issued after return is

of address change. Write new address in section E.

used to report the accumulative total for the quarter.

posted to account. Interest is calculated by 1.25% for

each month on the unpaid tax liability and returns not

ITEM F. (Out of Business) - If this is your last return

Paper

postmarked on or before their due date.

as an employer, check Box F and give the Date Out

If filing by paper, make checks or money orders pay-

of Business.

LINE 4. (Penalty) - A bill will be issued after return

able to the Oklahoma Tax Commission and mail with

is posted to account. If this return or any payment is

your return to: (This address is for payments ONLY)

ITEM G. (Amended Return) - Check to correct a

filed after the due date, multiply the amount on line 2

previously filed return. In Item B include the reporting

Oklahoma Tax Commission

by 10%.

period you are amending. Enter total corrected

Post Office Box 26920

amounts on lines 1, 2 and 5 of the return and not the

Oklahoma City, OK 73126-0920

LINE 5. (Total) - Total the amounts on lines 2 through

amount of the adjustment.

4 and enter on line 5.

Do NOT mail correspondence to the address above.

ITEM H. (Number of Employees) - Enter the number

of employees for this filing period on the line provided.

Please Detach Here and Return Coupon Below

Do not fold, staple, or paper clip

Do not tear or cut below line

WTH

10001

Oklahoma Quarterly Wage Withholding Tax Return

A. Taxpayer FEIN

B. Quarter Ending

C. Due Date

D. Filing Frequency

Date Out

of Business: __________________

MM/DD/YY

E. Address Change

F. Out of Business

G. Amended Report

H. Number of Employees: _______________

-Office Use Only-

- - - - - - - - - - - Dollars - - - - - - - - - -

- - Cents - -

___________________________________________________

1. Wages Paid

__________________________ . ________

E.

Name

2. Tax Withheld __________________________ . ________

___________________________________________________

Address

3. Interest

(+) __________________________ . ________

___________________________________________________

City

State

ZIP

4. Penalty

(+) __________________________ . ________

Signature: _____________________________________

Date: ______________

The information contained in this return and any attachments is true and correct to the best of my knowledge.

5. Total

(=) __________________________ . ________

1

1