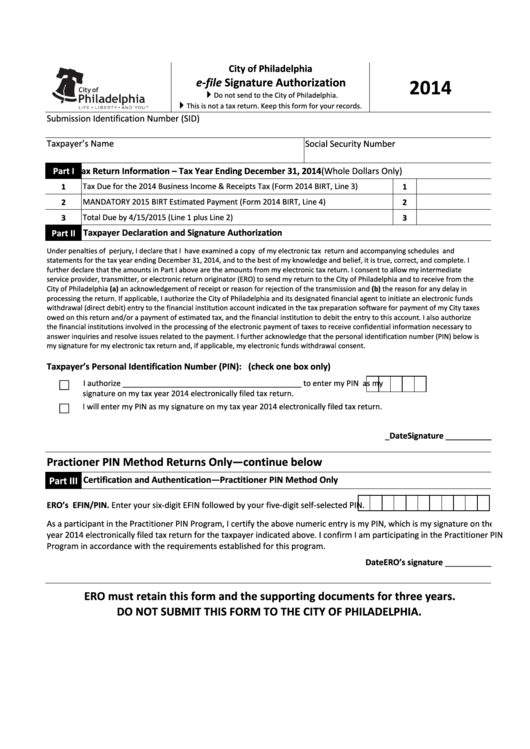

City of Philadelphia

e-file Signature Authorization

2014

Do not send to the City of Philadelphia.

This is not a tax return. Keep this form for your records.

Submission Identification Number (SID)

Taxpayer’s Name

Social Security Number

Part I

Tax Return Information – Tax Year Ending December 31, 2014 (Whole Dollars Only)

1

Tax Due for the 2014 Business Income & Receipts Tax (Form 2014 BIRT, Line 3)

1

2

MANDATORY 2015 BIRT Estimated Payment (Form 2014 BIRT, Line 4)

2

3

Total Due by 4/15/2015 (Line 1 plus Line 2)

3

Part II

Taxpayer Declaration and Signature Authorization

Under penalties of perjury, I declare that I have examined a copy of my electronic tax return and accompanying schedules and

statements for the tax year ending December 31, 2014, and to the best of my knowledge and belief, it is true, correct, and co mplete. I

further declare that the amounts in Part I above are the amounts from my electronic tax return. I consent to allow my intermediate

service provider, transmitter, or electronic return originator (ERO) to send my return to the City of Philadelphia and to receive from the

City of Philadelphia (a) an acknowledgement of receipt or reason for rejection of the transmission and (b) the reason for any delay in

processing the return. If applicable, I authorize the City of Philadelphia and its designated financial agent to initiate an electronic funds

withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of my City taxes

owed on this return and/or a payment of estimated tax, and the financial institution to debit the entry to this account. I also authorize

the financial institutions involved in the processing of the electronic payment of taxes to receive confidential information necessary to

answer inquiries and resolve issues related to the payment. I further acknowledge that the personal identification number (PIN) below is

my signature for my electronic tax return and, if applicable, my electronic funds withdrawal consent.

Taxpayer’s Personal Identification Number (PIN): (check one box only)

I authorize __________________________________________ to enter my PIN

as my

signature on my tax year 2014 electronically filed tax return.

I will enter my PIN as my signature on my tax year 2014 electronically filed tax return.

Signature _____________________________________________________________

Date

_

______________________

Practitioner PIN Method Returns Only—continue below

Certification and Authentication—Practitioner PIN Method Only

Part III

ERO’s EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN.

As a participant in the Practitioner PIN Program, I certify the above numeric entry is my PIN, which is my signature on the tax

year 2014 electronically filed tax return for the taxpayer indicated above. I confirm I am participating in the Practitioner PIN

Program in accordance with the requirements established for this program.

ERO’s signature ________________________________________________________

Date

_______________________

ERO must retain this form and the supporting documents for three years.

DO NOT SUBMIT THIS FORM TO THE CITY OF PHILADELPHIA.

1

1