Richland Parish Sales/use Tax Report Form

ADVERTISEMENT

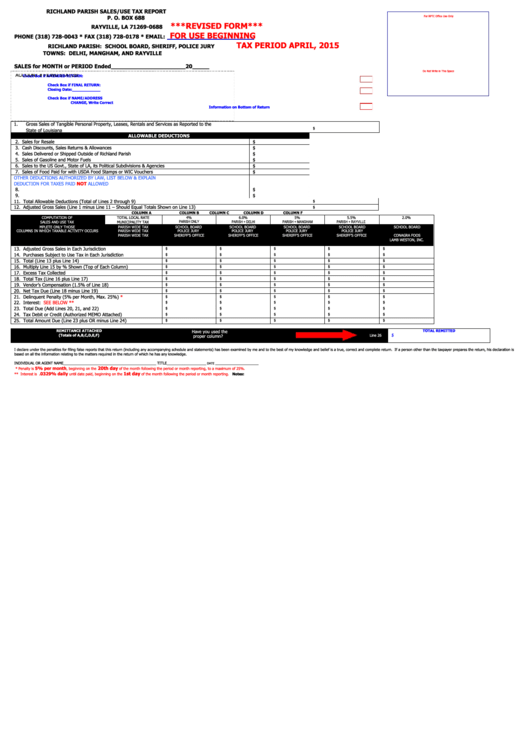

RICHLAND PARISH SALES/USE TAX REPORT

P. O. BOX 688

For RPTC Office Use Only

***REVISED FORM***

RAYVILLE, LA 71269-0688

FOR USE BEGINNING

PHONE (318) 728-0043 * FAX (318) 728-0178 * EMAIL:

TAX PERIOD APRIL, 2015

RICHLAND PARISH: SCHOOL BOARD, SHERIFF, POLICE JURY

TOWNS: DELHI, MANGHAM, AND RAYVILLE

SALES for MONTH or PERIOD Ended______________________20_____

Do Not Write in This Space

Check Box if AMENDED RETURN:

A CCOUN T #

FILING STA TUS:

Check Box if FINAL RETURN:

Closing Date:____________

Check Box if NAME/ADDRESS

CHANGE, Write Correct

Information on Bottom of Return

1.

Gross Sales of Tangible Personal Property, Leases, Rentals and Services as Reported to the

$

State of Louisiana

ALLOWABLE DEDUCTIONS

2. Sales for Resale

$

3. Cash Discounts, Sales Returns & Allowances

$

4. Sales Delivered or Shipped Outside of Richland Parish

$

5. Sales of Gasoline and Motor Fuels

$

6. Sales to the US Govt., State of LA, its Political Subdivisions & Agencies

$

7. Sales of Food Paid for with USDA Food Stamps or WIC Vouchers

$

OTHER DEDUCTIONS AUTHORIZED BY LAW, LIST BELOW & EXPLAIN

DEDUCTION FOR TAXES PAID

NOT

ALLOWED

8.

$

9.

$

11. Total Allowable Deductions (Total of Lines 2 through 9)

$

12. Adjusted Gross Sales (Line 1 minus Line 11 – Should Equal Totals Shown on Line 13)

$

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN F

COMPUTATION OF

TOTAL LOCAL RATE

4%

6.0%

5%

5.5%

2.0%

SALES AND USE TAX

MUNICIPALITY TAX

PARISH ONLY

PARISH + DELHI

PARISH + MANGHAM

PARISH + RAYVILLE

MPLETE ONLY THOSE

PARISH WIDE TAX

SCHOOL BOARD

SCHOOL BOARD

SCHOOL BOARD

SCHOOL BOARD

SCHOOL BOARD

COLUMNS IN WHICH TAXABLE ACTIVITY OCCURS

PARISH WIDE TAX

POLICE JURY

POLICE JURY

POLICE JURY

POLICE JURY

PARISH WIDE TAX

SHERIFF’S OFFICE

SHERIFF’S OFFICE

SHERIFF’S OFFICE

SHERIFF’S OFFICE

CONAGRA FOOS

LAMB WESTON, INC.

13. Adjusted Gross Sales in Each Jurisdiction

$

$

$

$

$

14. Purchases Subject to Use Tax in Each Jurisdiction

$

$

$

$

$

15. Total (Line 13 plus Line 14)

$

$

$

$

$

16. Multiply Line 15 by % Shown (Top of Each Column)

$

$

$

$

$

17. Excess Tax Collected

$

$

$

$

$

18. Total Tax (Line 16 plus Line 17)

$

$

$

$

$

19. Vendor’s Compensation (1.5% of Line 18)

$

$

$

$

$

20. Net Tax Due (Line 18 minus Line 19)

$

$

$

$

$

21. Delinquent Penalty (5% per Month, Max. 25%)

*

$

$

$

$

$

22. Interest:

SEE BELOW **

$

$

$

$

$

23. Total Due (Add Lines 20, 21, and 22)

$

$

$

$

$

24. Tax Debit or Credit (Authorized MEMO Attached)

$

$

$

$

$

25. Total Amount Due (Line 23 plus OR minus Line 24)

$

$

$

$

$

REMITTANCE ATTACHED

TOTAL REMITTED

Have you used the

(Totals of A,B,C,D,E,F)

Line 26

proper column?

$

I declare under the penalties for filing false reports that this return (including any accompanying schedule and statements) has been examined by me and to the best of my knowledge and belief is a true, correct and complete return. If a person other than the taxpayer prepares the return, his declaration is

based on all the information relating to the matters required in the return of which he has any knowledge.

INDIVIDUAL OR AGENT NAME_______________________________________________ TITLE____________________

DATE ___________________________

5% per month

20th day

* Penalty is

, beginning on the

of the month following the period or month reporting, to a maximum of 25%.

1st day

0329% daily

** Interest is .

until date paid, beginning on the

of the month following the period or month reporting.

Notes:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1