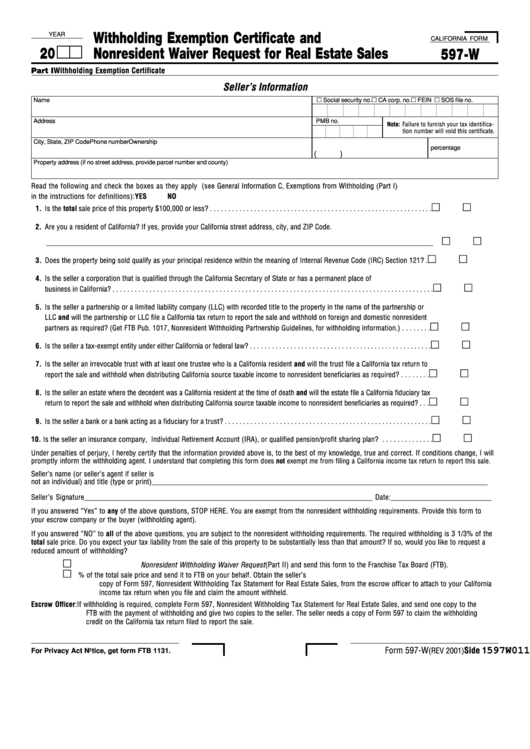

YEAR

Withholding Exemption Certificate and

CALIFORNIA FORM

20

Nonresident Waiver Request for Real Estate Sales

597-W

Part I Withholding Exemption Certificate

Seller’s Information

Name

Social security no.

CA corp. no.

FEIN

SOS file no.

Address

PMB no.

Note: Failure to furnish your tax identifica-

tion number will void this certificate.

City, State, ZIP Code

Phone number

Ownership

percentage

(

)

Property address (if no street address, provide parcel number and county)

Read the following and check the boxes as they apply (see General Information C, Exemptions from Withholding (Part I)

in the instructions for definitions):

YES

NO

1. Is the total sale price of this property $100,000 or less? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Are you a resident of California? If yes, provide your California street address, city, and ZIP Code.

__________________________________________________________________________________________________________

3. Does the property being sold qualify as your principal residence within the meaning of Internal Revenue Code (IRC) Section 121? .

4. Is the seller a corporation that is qualified through the California Secretary of State or has a permanent place of

business in California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Is the seller a partnership or a limited liability company (LLC) with recorded title to the property in the name of the partnership or

LLC and will the partnership or LLC file a California tax return to report the sale and withhold on foreign and domestic nonresident

partners as required? (Get FTB Pub. 1017, Nonresident Withholding Partnership Guidelines, for withholding information.) . . . . . . . .

6. Is the seller a tax-exempt entity under either California or federal law? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Is the seller an irrevocable trust with at least one trustee who is a California resident and will the trust file a California tax return to

report the sale and withhold when distributing California source taxable income to nonresident beneficiaries as required? . . . . . . . .

8. Is the seller an estate where the decedent was a California resident at the time of death and will the estate file a California fiduciary tax

return to report the sale and withhold when distributing California source taxable income to nonresident beneficiaries as required? . . .

9. Is the seller a bank or a bank acting as a fiduciary for a trust? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Is the seller an insurance company, Individual Retirement Account (IRA), or qualified pension/profit sharing plan? . . . . . . . . . . . . . .

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. If conditions change, I will

promptly inform the withholding agent

. I understand that completing this form does not exempt me from filing a California income tax return to report this sale.

Seller’s name (or seller’s agent if seller is

not an individual) and title (type or print) ____________________________________________________________________________________________

Seller’s Signature_____________________________________________________________________________ Date:___________________________

If you answered “Yes” to any of the above questions, STOP HERE. You are exempt from the nonresident withholding requirements. Provide this form to

your escrow company or the buyer (withholding agent).

If you answered “NO” to all of the above questions, you are subject to the nonresident withholding requirements. The required withholding is 3 1/3% of the

total sale price. Do you expect your tax liability from the sale of this property to be substantially less than that amount? If so, would you like to request a

reduced amount of withholding?

Yes.

Complete the Nonresident Withholding Waiver Request (Part II) and send this form to the Franchise Tax Board (FTB).

No.

STOP HERE. Your escrow officer will withhold 3 1/3% of the total sale price and send it to FTB on your behalf. Obtain the seller’s

copy of Form 597, Nonresident Withholding Tax Statement for Real Estate Sales, from the escrow officer to attach to your California

income tax return when you file and claim the amount withheld.

Escrow Officer:

If withholding is required, complete Form 597, Nonresident Withholding Tax Statement for Real Estate Sales, and send one copy to the

FTB with the payment of withholding and give two copies to the seller. The seller needs a copy of Form 597 to claim the withholding

credit on the California tax return filed to report the sale.

597W01109

Form 597-W

Side 1

(REV 2001)

For Privacy Act Notice, get form FTB 1131.

1

1 2

2