Form 20-Cd - Corporation Estimated Tax Worksheet - Alabama Department Of Revenue

ADVERTISEMENT

A

D

R

9/06

LABAMA

EPARTMENT OF

EVENUE

C

I

T

ORPORATION

NCOME

AX

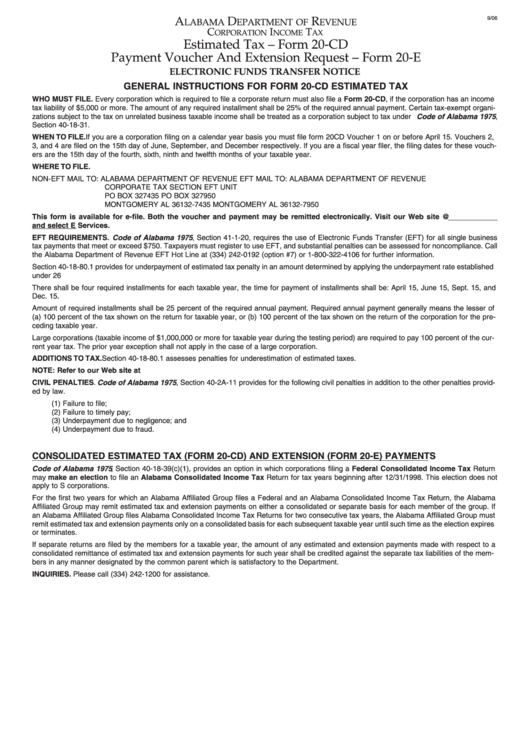

Estimated Tax – Form 20-CD

Payment Voucher And Extension Request – Form 20-E

ELECTRONIC FUNDS TRANSFER NOTICE

GENERAL INSTRUCTIONS FOR FORM 20-CD ESTIMATED TAX

WHO MUST FILE. Every corporation which is required to file a corporate return must also file a Form 20-CD, if the corporation has an income

tax liability of $5,000 or more. The amount of any required installment shall be 25% of the required annual payment. Certain tax-exempt organi-

zations subject to the tax on unrelated business taxable income shall be treated as a corporation subject to tax under Code of Alabama 1975 ,

Section 40-18-31.

WHEN TO FILE. If you are a corporation filing on a calendar year basis you must file form 20CD Voucher 1 on or before April 15. Vouchers 2,

3, and 4 are filed on the 15th day of June, September, and December respectively. If you are a fiscal year filer, the filing dates for these vouch-

ers are the 15th day of the fourth, sixth, ninth and twelfth months of your taxable year.

WHERE TO FILE.

NON-EFT MAIL TO: ALABAMA DEPARTMENT OF REVENUE

EFT MAIL TO:

ALABAMA DEPARTMENT OF REVENUE

CORPORATE TAX SECTION

EFT UNIT

PO BOX 327435

PO BOX 327950

MONTGOMERY AL 36132-7435

MONTGOMERY AL 36132-7950

This form is available for e-file. Both the voucher and payment may be remitted electronically. Visit our Web site @

alabama.gov and select E Services.

EFT REQUIREMENTS. Code of Alabama 1975 , Section 41-1-20, requires the use of Electronic Funds Transfer (EFT) for all single business

tax payments that meet or exceed $750. Taxpayers must register to use EFT, and substantial penalties can be assessed for noncompliance. Call

the Alabama Department of Revenue EFT Hot Line at (334) 242-0192 (option #7) or 1-800-322-4106 for further information.

Section 40-18-80.1 provides for underpayment of estimated tax penalty in an amount determined by applying the underpayment rate established

under 26 U.S.C. Section 6621.

There shall be four required installments for each taxable year, the time for payment of installments shall be: April 15, June 15, Sept. 15, and

Dec. 15.

Amount of required installments shall be 25 percent of the required annual payment. Required annual payment generally means the lesser of

(a) 100 percent of the tax shown on the return for taxable year, or (b) 100 percent of the tax shown on the return of the corporation for the pre-

ceding taxable year.

Large corporations (taxable income of $1,000,000 or more for taxable year during the testing period) are required to pay 100 percent of the cur-

rent year tax. The prior year exception shall not apply in the case of a large corporation.

ADDITIONS TO TAX. Section 40-18-80.1 assesses penalties for underestimation of estimated taxes.

NOTE: Refer to our Web site at alabama.gov for recent law changes which may affect your filing requirements.

CIVIL PENALTIES. Code of Alabama 1975 , Section 40-2A-11 provides for the following civil penalties in addition to the other penalties provid-

ed by law.

(1) Failure to file;

(2) Failure to timely pay;

(3) Underpayment due to negligence; and

(4) Underpayment due to fraud.

CONSOLIDATED ESTIMATED TAX (FORM 20-CD) AND EXTENSION (FORM 20-E) PAYMENTS

Code of Alabama 1975 , Section 40-18-39(c)(1), provides an option in which corporations filing a Federal Consolidated Income Tax Return

may make an election to file an Alabama Consolidated Income Tax Return for tax years beginning after 12/31/1998. This election does not

apply to S corporations.

For the first two years for which an Alabama Affiliated Group files a Federal and an Alabama Consolidated Income Tax Return, the Alabama

Affiliated Group may remit estimated tax and extension payments on either a consolidated or separate basis for each member of the group. If

an Alabama Affiliated Group files Alabama Consolidated Income Tax Returns for two consecutive tax years, the Alabama Affiliated Group must

remit estimated tax and extension payments only on a consolidated basis for each subsequent taxable year until such time as the election expires

or terminates.

If separate returns are filed by the members for a taxable year, the amount of any estimated and extension payments made with respect to a

consolidated remittance of estimated tax and extension payments for such year shall be credited against the separate tax liabilities of the mem-

bers in any manner designated by the common parent which is satisfactory to the Department.

INQUIRIES. Please call (334) 242-1200 for assistance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3