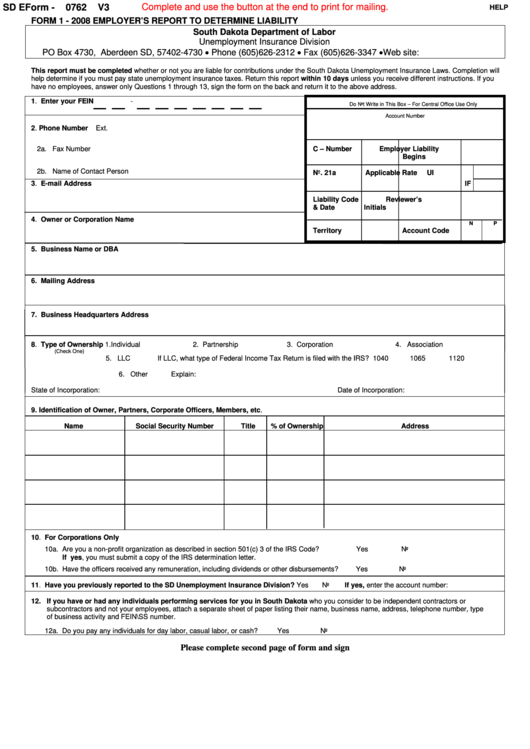

Complete and use the button at the end to print for mailing.

SD EForm -

0762

V3

HELP

FORM 1 - 2008 EMPLOYER’S REPORT TO DETERMINE LIABILITY

South Dakota Department of Labor

Unemployment Insurance Division

PO Box 4730, Aberdeen SD, 57402-4730 • Phone (605)626-2312 • Fax (605)626-3347 • Web site:

This report must be completed whether or not you are liable for contributions under the South Dakota Unemployment Insurance Laws. Completion will

help determine if you must pay state unemployment insurance taxes. Return this report within 10 days unless you receive different instructions. If you

have no employees, answer only Questions 1 through 13, sign the form on the back and return it to the above address.

1. Enter your FEIN

-

Do Not Write in This Box – For Central Office Use Only

Account Number

2. Phone Number

Ext.

2a. Fax Number

C – Number

Employer Liability

Begins

2b. Name of Contact Person

No. 21a

Applicable Rate

UI

3. E-mail Address

IF

Liability Code

Reviewer’s

& Date

Initials

4. Owner or Corporation Name

N

P

Territory

Account Code

5. Business Name or DBA

6. Mailing Address

7. Business Headquarters Address

8. Type of Ownership

1. Individual

2. Partnership

3. Corporation

4. Association

(Check One)

5. LLC

If LLC, what type of Federal Income Tax Return is filed with the IRS? 1040

1065

1120

6. Other

Explain:

State of Incorporation:

Date of Incorporation:

9.

Identification of Owner, Partners, Corporate Officers, Members, etc.

Name

Social Security Number

Title

% of Ownership

Address

10. For Corporations Only

10a. Are you a non-profit organization as described in section 501(c) 3 of the IRS Code?

Yes

No

If yes, you must submit a copy of the IRS determination letter.

10b. Have the officers received any remuneration, including dividends or other disbursements?

Yes

No

11. Have you previously reported to the SD Unemployment Insurance Division? Yes

No

If yes, enter the account number:

12. If you have or had any individuals performing services for you in South Dakota who you consider to be independent contractors or

subcontractors and not your employees, attach a separate sheet of paper listing their name, business name, address, telephone number, type

of business activity and FEIN\SS number.

12a. Do you pay any individuals for day labor, casual labor, or cash?

Yes

No

Please complete second page of form and sign

1

1 2

2