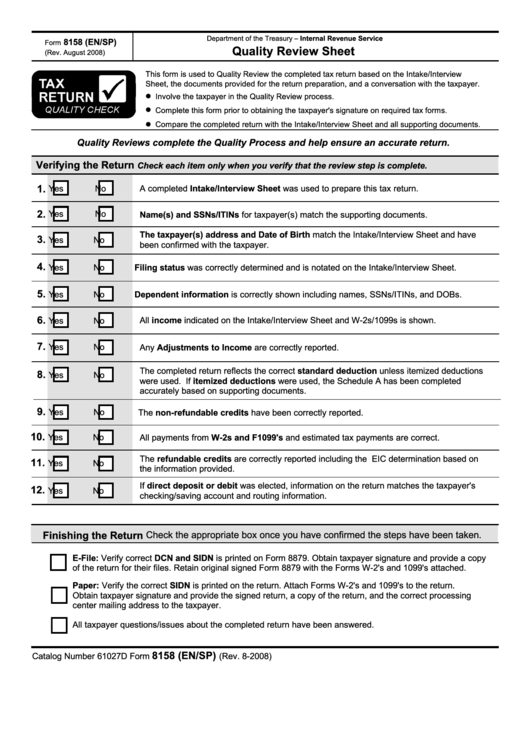

Form 8158 - Quality Review Sheet

ADVERTISEMENT

Department of the Treasury – Internal Revenue Service

8158 (EN/SP)

Form

Quality Review Sheet

(Rev. August 2008)

This form is used to Quality Review the completed tax return based on the Intake/Interview

Sheet, the documents provided for the return preparation, and a conversation with the taxpayer.

•

Involve the taxpayer in the Quality Review process.

•

Complete this form prior to obtaining the taxpayer's signature on required tax forms.

•

Compare the completed return with the Intake/Interview Sheet and all supporting documents.

Quality Reviews complete the Quality Process and help ensure an accurate return.

Verifying the Return

Check each item only when you verify that the review step is complete.

1.

Yes

No

A completed Intake/Interview Sheet was used to prepare this tax return.

2.

Yes

No

Name(s) and SSNs/ITINs for taxpayer(s) match the supporting documents.

The taxpayer(s) address and Date of Birth match the Intake/Interview Sheet and have

3.

Yes

No

been confirmed with the taxpayer.

4.

Yes

No

Filing status was correctly determined and is notated on the Intake/Interview Sheet.

5.

Yes

No

Dependent information is correctly shown including names, SSNs/ITINs, and DOBs.

6.

Yes

No

All income indicated on the Intake/Interview Sheet and W-2s/1099s is shown.

7.

Yes

No

Any Adjustments to Income are correctly reported.

The completed return reflects the correct standard deduction unless itemized deductions

8.

Yes

No

were used. If itemized deductions were used, the Schedule A has been completed

accurately based on supporting documents.

9.

Yes

No

The non-refundable credits have been correctly reported.

10.

Yes

No

All payments from W-2s and F1099's and estimated tax payments are correct.

The refundable credits are correctly reported including the EIC determination based on

11.

Yes

No

the information provided.

If direct deposit or debit was elected, information on the return matches the taxpayer's

12.

Yes

No

checking/saving account and routing information.

Finishing the Return

Check the appropriate box once you have confirmed the steps have been taken.

E-File: Verify correct DCN and SIDN is printed on Form 8879. Obtain taxpayer signature and provide a copy

of the return for their files. Retain original signed Form 8879 with the Forms W-2's and 1099's attached.

Paper: Verify the correct SIDN is printed on the return. Attach Forms W-2's and 1099's to the return.

Obtain taxpayer signature and provide the signed return, a copy of the return, and the correct processing

center mailing address to the taxpayer.

All taxpayer questions/issues about the completed return have been answered.

8158 (EN/SP)

Catalog Number 61027D

Form

(Rev. 8-2008)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2