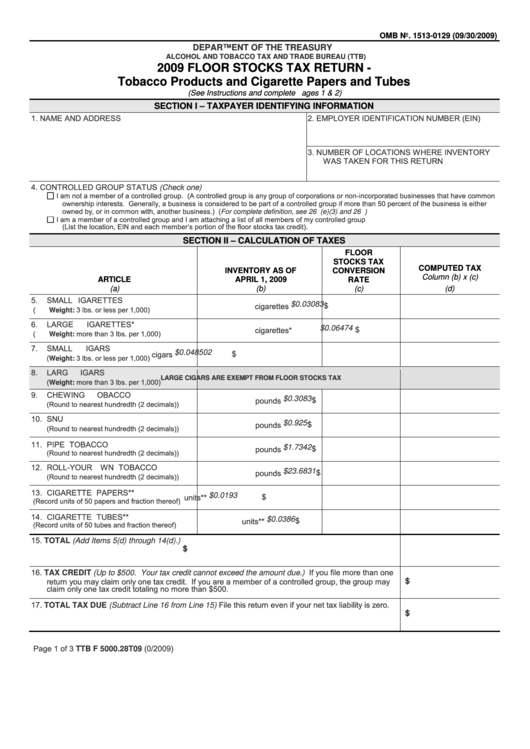

OMB No. 1513-0129 (09/30/2009)

DEPARTMENT OF THE TREASURY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

2009 FLOOR STOCKS TAX RETURN -

Tobacco Products and Cigarette Papers and Tubes

(See Instructions and complete ages 1 & 2)

SECTION I – TAXPAYER IDENTIFYING INFORMATION

1.

NAME AND ADDRESS

2.

EMPLOYER IDENTIFICATION NUMBER (EIN)

3.

NUMBER OF LOCATIONS WHERE INVENTORY

WAS TAKEN FOR THIS RETURN

4.

CONTROLLED GROUP STATUS (Check one)

I am not a member of a controlled group. (A controlled group is any group of corporations or non-incorporated businesses that have common

ownership interests. Generally, a business is considered to be part of a controlled group if more than 50 percent of the business is either

owned by, or in common with, another business.) (For complete definition, see 26 U.S.C. 5061(e)(3) and 26 U.S.C. 1563)

I am a member of a controlled group and I am attaching a list of all members of my controlled group

(List the location, EIN and each member’s portion of the floor stocks tax credit).

SECTION II – CALCULATION OF TAXES

FLOOR

STOCKS TAX

COMPUTED TAX

INVENTORY AS OF

CONVERSION

Column (b) x (c)

APRIL 1, 2009

ARTICLE

RATE

(a)

(b)

(c)

(d)

5. SMALL

IGARETTES

$0.03083

$

cigarettes

(Weight: 3 lbs. or less per 1,000)

6. LARGE

IGARETTES*

$0.06474

$

cigarettes*

(Weight: more than 3 lbs. per 1,000)

7. SMALL

IGARS

$

cigars

$0.048502

(Weight: 3 lbs. or less per 1,000)

8. LARG

IGARS

LARGE CIGARS ARE EXEMPT FROM FLOOR STOCKS TAX

(Weight: more than 3 lbs. per 1,000)

9. CHEWING

OBACCO

$0.3083

$

pounds

(Round to nearest hundredth (2 decimals))

10. SNU

$0.925

$

pounds

(Round to nearest hundredth (2 decimals))

11. PIPE TOBACCO

$

pounds

$1.7342

(Round to nearest hundredth (2 decimals))

12. ROLL-YOUR

WN TOBACCO

$

pounds

$23.6831

(Round to nearest hundredth (2 decimals))

13. CIGARETTE PAPERS**

$

units**

$0.0193

(Record units of 50 papers and fraction thereof)

14. CIGARETTE TUBES**

$

$0.0386

units**

(Record units of 50 tubes and fraction thereof)

15. TOTAL (Add Items 5(d) through 14(d).)

$

16. TAX CREDIT (Up to $500. Your tax credit cannot exceed the amount due.) If you file more than one

$

return you may claim only one tax credit. If you are a member of a controlled group, the group may

claim only one tax credit totaling no more than $500.

17. TOTAL TAX DUE (Subtract Line 16 from Line 15) File this return even if your net tax liability is zero.

$

Page 1 of 3

TTB F 5000.28T09 (0 /2009)

1

1 2

2 3

3