Resident Information Sheet - City Of Munroe Falls Income Tax Department

ADVERTISEMENT

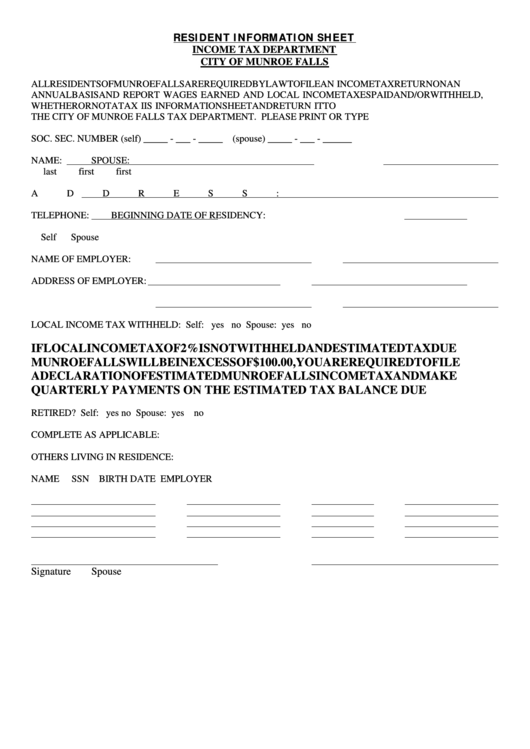

RESIDENT INFORMATION SHEET

INCOME TAX DEPARTMENT

CITY OF MUNROE FALLS

ALL RESIDENTS OF MUNROE FALLS ARE REQUIRED BY LAW TO FILE AN INCOME TAX RETURN ON AN

ANNUAL BASIS AND REPORT WAGES EARNED AND LOCAL INCOME TAXES PAID AND/OR WITHHELD,

WHETHER OR NOT A TAX IS DUE. PLEASE COMPLETE THIS INFORMATION SHEET AND RETURN IT TO

THE CITY OF MUNROE FALLS TAX DEPARTMENT. PLEASE PRINT OR TYPE

SOC. SEC. NUMBER (self) _____ - ___ - _____

(spouse) _____ - ___ - ______

NAME:

SPOUSE:

last

first

first

ADDRESS:

TELEPHONE:

BEGINNING DATE OF RESIDENCY:

Self

Spouse

NAME OF EMPLOYER:

ADDRESS OF EMPLOYER:

LOCAL INCOME TAX WITHHELD: Self:

yes

no

Spouse: yes

no

IF LOCAL INCOME TAX OF 2% IS NOT WITHHELD AND ESTIMATED TAX DUE

MUNROE FALLS WILL BE IN EXCESS OF $100.00, YOU ARE REQUIRED TO FILE

A DECLARATION OF ESTIMATED MUNROE FALLS INCOME TAX AND MAKE

QUARTERLY PAYMENTS ON THE ESTIMATED TAX BALANCE DUE

RETIRED? Self:

yes

no

Spouse: yes

no

COMPLETE AS APPLICABLE:

OTHERS LIVING IN RESIDENCE:

NAME

SSN

BIRTH DATE

EMPLOYER

Signature

Spouse

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1