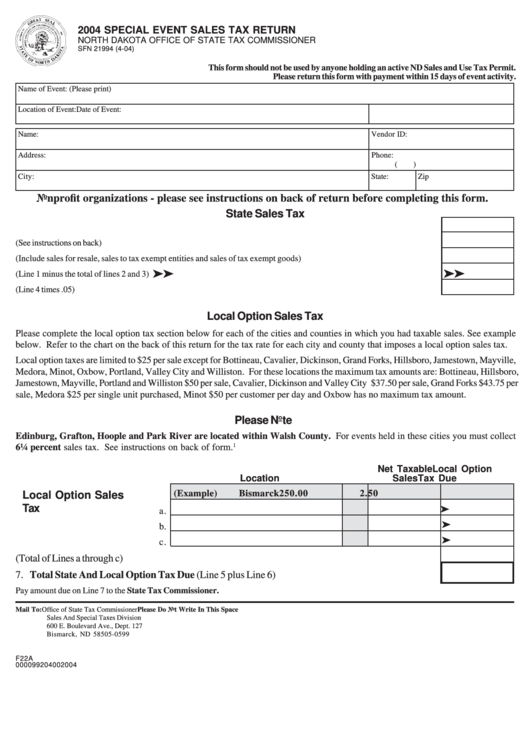

2004 SPECIAL EVENT SALES TAX RETURN

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 21994 (4-04)

This form should not be used by anyone holding an active ND Sales and Use Tax Permit.

Please return this form with payment within 15 days of event activity.

Name of Event: (Please print)

Location of Event:

Date of Event:

Name:

Vendor ID:

Address:

Phone:

(

)

City:

State:

Zip

Nonprofit organizations - please see instructions on back of return before completing this form.

State Sales Tax

1. Total Sales ..........................................................................................................................................

2. Nontaxable Sales by Qualifying Nonprofit Organization

(See instructions on back) ............................................

3. Nontaxable Sales

(Include sales for resale, sales to tax exempt entities and sales of tax exempt goods) ......................

! ! ! ! !

4. Net Taxable Sales

(Line 1 minus the total of lines 2 and 3) ...........................................................................................

5. State Tax Due

(Line 4 times .05) .....................................................................................................................................

Local Option Sales Tax

Please complete the local option tax section below for each of the cities and counties in which you had taxable sales. See example

below. Refer to the chart on the back of this return for the tax rate for each city and county that imposes a local option sales tax.

Local option taxes are limited to $25 per sale except for Bottineau, Cavalier, Dickinson, Grand Forks, Hillsboro, Jamestown, Mayville,

Medora, Minot, Oxbow, Portland, Valley City and Williston. For these locations the maximum tax amounts are: Bottineau, Hillsboro,

Jamestown, Mayville, Portland and Williston $50 per sale, Cavalier, Dickinson and Valley City $37.50 per sale, Grand Forks $43.75 per

sale, Medora $25 per single unit purchased, Minot $50 per customer per day and Oxbow has no maximum tax amount.

Please Note

Edinburg, Grafton, Hoople and Park River are located within Walsh County. For events held in these cities you must collect

1

6¼ percent sales tax. See instructions on back of form.

Net Taxable

Local Option

Location

Sales

Tax Due

(Example)

Bismarck

250.00

2.50

Local Option Sales

Tax

!

a.

!

b.

!

c.

6. Total Local Option Tax Due (Total of Lines a through c) .......................................................................

7. Total State And Local Option Tax Due (Line 5 plus Line 6) .............................................................

Pay amount due on Line 7 to the State Tax Commissioner.

Mail To: Office of State Tax Commissioner

Please Do Not Write In This Space

Sales And Special Taxes Division

600 E. Boulevard Ave., Dept. 127

Bismarck, ND 58505-0599

F22A

000099204002004

1

1 2

2