Instructions For Form Lgl-001 - Power Of Attorney

ADVERTISEMENT

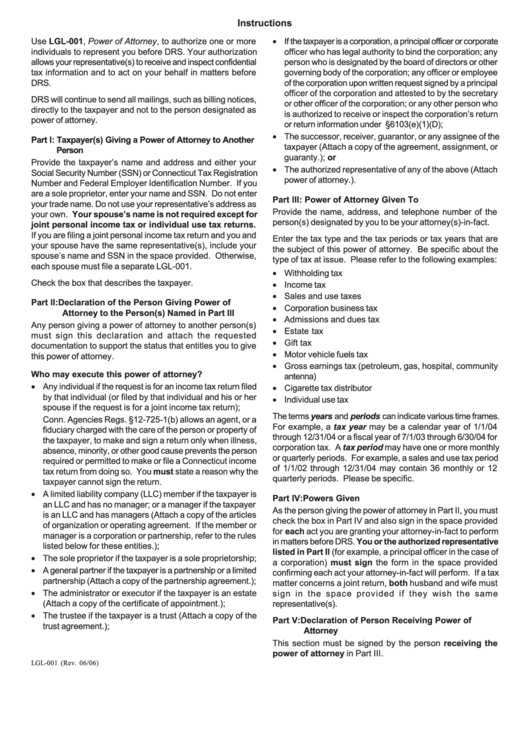

Instructions

• If the taxpayer is a corporation, a principal officer or corporate

Use LGL-001, Power of Attorney, to authorize one or more

individuals to represent you before DRS. Your authorization

officer who has legal authority to bind the corporation; any

allows your representative(s) to receive and inspect confidential

person who is designated by the board of directors or other

tax information and to act on your behalf in matters before

governing body of the corporation; any officer or employee

DRS.

of the corporation upon written request signed by a principal

officer of the corporation and attested to by the secretary

DRS will continue to send all mailings, such as billing notices,

or other officer of the corporation; or any other person who

directly to the taxpayer and not to the person designated as

is authorized to receive or inspect the corporation’s return

power of attorney.

or return information under I.R.C. §6103(e)(1)(D);

• The successor, receiver, guarantor, or any assignee of the

Part I: Taxpayer(s) Giving a Power of Attorney to Another

taxpayer (Attach a copy of the agreement, assignment, or

Person

guaranty.); or

Provide the taxpayer’s name and address and either your

• The authorized representative of any of the above (Attach

Social Security Number (SSN) or Connecticut Tax Registration

power of attorney.).

Number and Federal Employer Identification Number. If you

are a sole proprietor, enter your name and SSN. Do not enter

Part III: Power of Attorney Given To

your trade name. Do not use your representative’s address as

Provide the name, address, and telephone number of the

your own. Your spouse’s name is not required except for

person(s) designated by you to be your attorney(s)-in-fact.

joint personal income tax or individual use tax returns.

If you are filing a joint personal income tax return and you and

Enter the tax type and the tax periods or tax years that are

your spouse have the same representative(s), include your

the subject of this power of attorney. Be specific about the

spouse’s name and SSN in the space provided. Otherwise,

type of tax at issue. Please refer to the following examples:

each spouse must file a separate LGL-001.

• Withholding tax

Check the box that describes the taxpayer.

• Income tax

• Sales and use taxes

Part II: Declaration of the Person Giving Power of

• Corporation business tax

Attorney to the Person(s) Named in Part III

• Admissions and dues tax

Any person giving a power of attorney to another person(s)

• Estate tax

must sign this declaration and attach the requested

• Gift tax

documentation to support the status that entitles you to give

• Motor vehicle fuels tax

this power of attorney.

• Gross earnings tax (petroleum, gas, hospital, community

Who may execute this power of attorney?

antenna)

• Any individual if the request is for an income tax return filed

• Cigarette tax distributor

by that individual (or filed by that individual and his or her

• Individual use tax

spouse if the request is for a joint income tax return);

The terms years and periods can indicate various time frames.

Conn. Agencies Regs. §12-725-1(b) allows an agent, or a

For example, a tax year may be a calendar year of 1/1/04

fiduciary charged with the care of the person or property of

through 12/31/04 or a fiscal year of 7/1/03 through 6/30/04 for

the taxpayer, to make and sign a return only when illness,

corporation tax. A tax period may have one or more monthly

absence, minority, or other good cause prevents the person

or quarterly periods. For example, a sales and use tax period

required or permitted to make or file a Connecticut income

of 1/1/02 through 12/31/04 may contain 36 monthly or 12

tax return from doing so. You must state a reason why the

quarterly periods. Please be specific.

taxpayer cannot sign the return.

• A limited liability company (LLC) member if the taxpayer is

Part IV: Powers Given

an LLC and has no manager; or a manager if the taxpayer

As the person giving the power of attorney in Part II, you must

is an LLC and has managers (Attach a copy of the articles

check the box in Part IV and also sign in the space provided

of organization or operating agreement. If the member or

for each act you are granting your attorney-in-fact to perform

manager is a corporation or partnership, refer to the rules

in matters before DRS. You or the authorized representative

listed below for these entities.);

listed in Part II (for example, a principal officer in the case of

• The sole proprietor if the taxpayer is a sole proprietorship;

a corporation) must sign the form in the space provided

• A general partner if the taxpayer is a partnership or a limited

confirming each act your attorney-in-fact will perform. If a tax

partnership (Attach a copy of the partnership agreement.);

matter concerns a joint return, both husband and wife must

• The administrator or executor if the taxpayer is an estate

sign in the space provided if they wish the same

(Attach a copy of the certificate of appointment.);

representative(s).

• The trustee if the taxpayer is a trust (Attach a copy of the

Part V: Declaration of Person Receiving Power of

trust agreement.);

Attorney

This section must be signed by the person receiving the

power of attorney in Part III.

LGL-001 (Rev. 06/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1