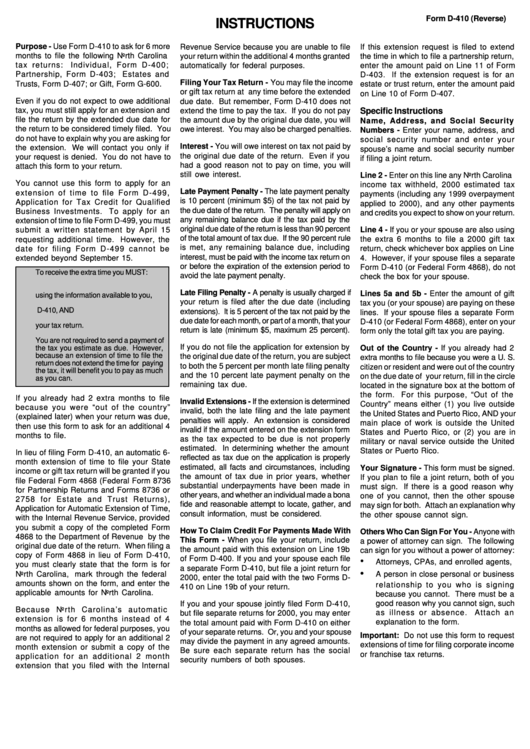

Instructions For Form D-410

ADVERTISEMENT

Form D-410 (Reverse)

INSTRUCTIONS

Purpose - Use Form D-410 to ask for 6 more

Revenue Service because you are unable to file

If this extension request is filed to extend

months to file the following North Carolina

your return within the additional 4 months granted

the time in which to file a partnership return,

tax returns:

Individual, Form D-400;

automatically for federal purposes.

enter the amount paid on Line 11 of Form

Partnership, Form D-403; Estates and

D-403. If the extension request is for an

Filing Your Tax Return - You may file the income

Trusts, Form D-407; or Gift, Form G-600.

estate or trust return, enter the amount paid

or gift tax return at any time before the extended

on Line 10 of Form D-407.

Even if you do not expect to owe additional

due date. But remember, Form D-410 does not

tax, you must still apply for an extension and

extend the time to pay the tax. If you do not pay

Specific Instructions

file the return by the extended due date for

the amount due by the original due date, you will

Name, Address, and Social Security

the return to be considered timely filed. You

owe interest. You may also be charged penalties.

Numbers - Enter your name, address, and

do not have to explain why you are asking for

social security number and enter your

Interest - You will owe interest on tax not paid by

the extension. We will contact you only if

spouse’s name and social security number

the original due date of the return. Even if you

your request is denied. You do not have to

if filing a joint return.

had a good reason not to pay on time, you will

attach this form to your return.

still owe interest.

Line 2 - Enter on this line any North Carolina

You cannot use this form to apply for an

income tax withheld, 2000 estimated tax

Late Payment Penalty - The late payment penalty

extension of time to file Form D-499,

payments (including any 1999 overpayment

is 10 percent (minimum $5) of the tax not paid by

Application for Tax Credit for Qualified

applied to 2000), and any other payments

the due date of the return. The penalty will apply on

Business Investments. To apply for an

and credits you expect to show on your return.

any remaining balance due if the tax paid by the

extension of time to file Form D-499, you must

original due date of the return is less than 90 percent

submit a written statement by April 15

Line 4 - If you or your spouse are also using

of the total amount of tax due. If the 90 percent rule

the extra 6 months to file a 2000 gift tax

requesting additional time. However, the

is met, any remaining balance due, including

date for filing Form D-499 cannot be

return, check whichever box applies on Line

interest, must be paid with the income tax return on

extended beyond September 15.

4. However, if your spouse files a separate

or before the expiration of the extension period to

Form D-410 (or Federal Form 4868), do not

To receive the extra time you MUST:

avoid the late payment penalty.

check the box for your spouse.

1.

Properly estimate your 2000 tax liability

Late Filing Penalty - A penalty is usually charged if

Lines 5a and 5b - Enter the amount of gift

using the information available to you,

your return is filed after the due date (including

2.

Enter your tax liability on Line 1 of Form

tax you (or your spouse) are paying on these

D-410, AND

extensions). It is 5 percent of the tax not paid by the

lines. If your spouse files a separate Form

3.

File Form D-410 by the regular due date of

due date for each month, or part of a month, that your

D-410 (or Federal Form 4868), enter on your

your tax return.

return is late (minimum $5, maximum 25 percent).

form only the total gift tax you are paying.

You are not required to send a payment of

If you do not file the application for extension by

the tax you estimate as due. However,

Out of the Country - If you already had 2

because an extension of time to file the

the original due date of the return, you are subject

extra months to file because you were a U. S.

return does not extend the time for paying

to both the 5 percent per month late filing penalty

citizen or resident and were out of the country

the tax, it will benefit you to pay as much

and the 10 percent late payment penalty on the

on the due date of your return, fill in the circle

as you can.

remaining tax due.

located in the signature box at the bottom of

the form. For this purpose, “Out of the

If you already had 2 extra months to file

Invalid Extensions - If the extension is determined

Country” means either (1) you live outside

because you were “out of the country”

invalid, both the late filing and the late payment

the United States and Puerto Rico, AND your

(explained later) when your return was due,

penalties will apply. An extension is considered

main place of work is outside the United

then use this form to ask for an additional 4

invalid if the amount entered on the extension form

States and Puerto Rico, or (2) you are in

months to file.

as the tax expected to be due is not properly

military or naval service outside the United

estimated. In determining whether the amount

States or Puerto Rico.

In lieu of filing Form D-410, an automatic 6-

reflected as tax due on the application is properly

month extension of time to file your State

estimated, all facts and circumstances, including

Your Signature - This form must be signed.

income or gift tax return will be granted if you

the amount of tax due in prior years, whether

If you plan to file a joint return, both of you

file Federal Form 4868 (Federal Form 8736

substantial underpayments have been made in

must sign. If there is a good reason why

for Partnership Returns and Forms 8736 or

other years, and whether an individual made a bona

one of you cannot, then the other spouse

2758 for Estate and Trust Returns),

fide and reasonable attempt to locate, gather, and

may sign for both. Attach an explanation why

Application for Automatic Extension of Time,

consult information, must be considered.

the other spouse cannot sign.

with the Internal Revenue Service, provided

you submit a copy of the completed Form

How To Claim Credit For Payments Made With

Others Who Can Sign For You - Anyone with

4868 to the Department of Revenue by the

This Form - When you file your return, include

a power of attorney can sign. The following

original due date of the return. When filing a

the amount paid with this extension on Line 19b

can sign for you without a power of attorney:

copy of Form 4868 in lieu of Form D-410,

of Form D-400. If you and your spouse each file

•

Attorneys, CPAs, and enrolled agents,

you must clearly state that the form is for

a separate Form D-410, but file a joint return for

•

North Carolina, mark through the federal

A person in close personal or business

2000, enter the total paid with the two Forms D-

amounts shown on the form, and enter the

relationship to you who is signing

410 on Line 19b of your return.

applicable amounts for North Carolina.

because you cannot. There must be a

good reason why you cannot sign, such

If you and your spouse jointly filed Form D-410,

Because North Carolina’s automatic

as illness or absence.

Attach an

but file separate returns for 2000, you may enter

extension is for 6 months instead of 4

explanation to the form.

the total amount paid with Form D-410 on either

months as allowed for federal purposes, you

of your separate returns. Or, you and your spouse

Important: Do not use this form to request

are not required to apply for an additional 2

may divide the payment in any agreed amounts.

extensions of time for filing corporate income

month extension or submit a copy of the

Be sure each separate return has the social

or franchise tax returns.

application for an additional 2 month

security numbers of both spouses.

extension that you filed with the Internal

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1