Instructions For Form Boe-501-Oa - Oil Spill Prevention And Administration Fee Return

ADVERTISEMENT

BOE-501-OA (BACK) REV. 9 (7-14)

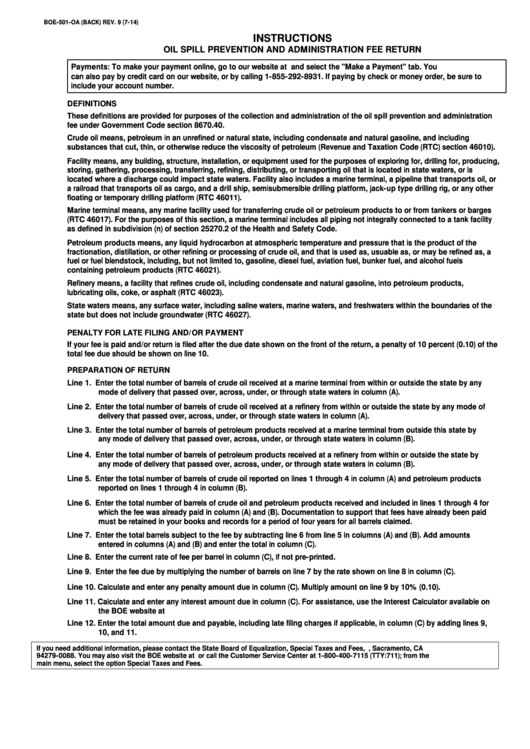

INSTRUCTIONS

OIL SPILL PREVENTION AND ADMINISTRATION FEE RETURN

Payments: To make your payment online, go to our website at and select the "Make a Payment" tab. You

can also pay by credit card on our website, or by calling 1-855-292-8931. If paying by check or money order, be sure to

include your account number.

DEFINITIONS

These definitions are provided for purposes of the collection and administration of the oil spill prevention and administration

fee under Government Code section 8670.40.

Crude oil means, petroleum in an unrefined or natural state, including condensate and natural gasoline, and including

substances that cut, thin, or otherwise reduce the viscosity of petroleum (Revenue and Taxation Code (RTC) section 46010).

Facility means, any building, structure, installation, or equipment used for the purposes of exploring for, drilling for, producing,

storing, gathering, processing, transferring, refining, distributing, or transporting oil that is located in state waters, or is

located where a discharge could impact state waters. Facility also includes a marine terminal, a pipeline that transports oil, or

a railroad that transports oil as cargo, and a drill ship, semisubmersible drilling platform, jack-up type drilling rig, or any other

floating or temporary drilling platform (RTC 46011).

Marine terminal means, any marine facility used for transferring crude oil or petroleum products to or from tankers or barges

(RTC 46017). For the purposes of this section, a marine terminal includes all piping not integrally connected to a tank facility

as defined in subdivision (n) of section 25270.2 of the Health and Safety Code.

Petroleum products means, any liquid hydrocarbon at atmospheric temperature and pressure that is the product of the

fractionation, distillation, or other refining or processing of crude oil, and that is used as, usuable as, or may be refined as, a

fuel or fuel blendstock, including, but not limited to, gasoline, diesel fuel, aviation fuel, bunker fuel, and alcohol fuels

containing petroleum products (RTC 46021).

Refinery means, a facility that refines crude oil, including condensate and natural gasoline, into petroleum products,

lubricating oils, coke, or asphalt (RTC 46023).

State waters means, any surface water, including saline waters, marine waters, and freshwaters within the boundaries of the

state but does not include groundwater (RTC 46027).

PENALTY FOR LATE FILING AND/OR PAYMENT

If your fee is paid and/or return is filed after the due date shown on the front of the return, a penalty of 10 percent (0.10) of the

total fee due should be shown on line 10.

PREPARATION OF RETURN

Line 1. Enter the total number of barrels of crude oil received at a marine terminal from within or outside the state by any

mode of delivery that passed over, across, under, or through state waters in column (A).

Line 2. Enter the total number of barrels of crude oil received at a refinery from within or outside the state by any mode of

delivery that passed over, across, under, or through state waters in column (A).

Line 3. Enter the total number of barrels of petroleum products received at a marine terminal from outside this state by

any mode of delivery that passed over, across, under, or through state waters in column (B).

Line 4. Enter the total number of barrels of petroleum products received at a refinery from within or outside the state by

any mode of delivery that passed over, across, under, or through state waters in column (B).

Line 5. Enter the total number of barrels of crude oil reported on lines 1 through 4 in column (A) and petroleum products

reported on lines 1 through 4 in column (B).

Line 6. Enter the total number of barrels of crude oil and petroleum products received and included in lines 1 through 4 for

which the fee was already paid in column (A) and (B). Documentation to support that fees have already been paid

must be retained in your books and records for a period of four years for all barrels claimed.

Line 7. Enter the total barrels subject to the fee by subtracting line 6 from line 5 in columns (A) and (B). Add amounts

entered in columns (A) and (B) and enter the total in column (C).

Line 8. Enter the current rate of fee per barrel in column (C), if not pre-printed.

Line 9. Enter the fee due by multiplying the number of barrels on line 7 by the rate shown on line 8 in column (C).

Line 10. Calculate and enter any penalty amount due in column (C). Multiply amount on line 9 by 10% (0.10).

Line 11. Calculate and enter any interest amount due in column (C). For assistance, use the Interest Calculator available on

the BOE website at https://efile.boe.ca.gov/boewebservices/interestCalculation.jsp.

Line 12. Enter the total amount due and payable, including late filing charges if applicable, in column (C) by adding lines 9,

10, and 11.

If you need additional information, please contact the State Board of Equalization, Special Taxes and Fees, P.O. Box 942879, Sacramento, CA

94279-0088. You may also visit the BOE website at or call the Customer Service Center at 1-800-400-7115 (TTY:711); from the

main menu, select the option Special Taxes and Fees.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1