Instructions For Filing Form Pc-10 & 20

ADVERTISEMENT

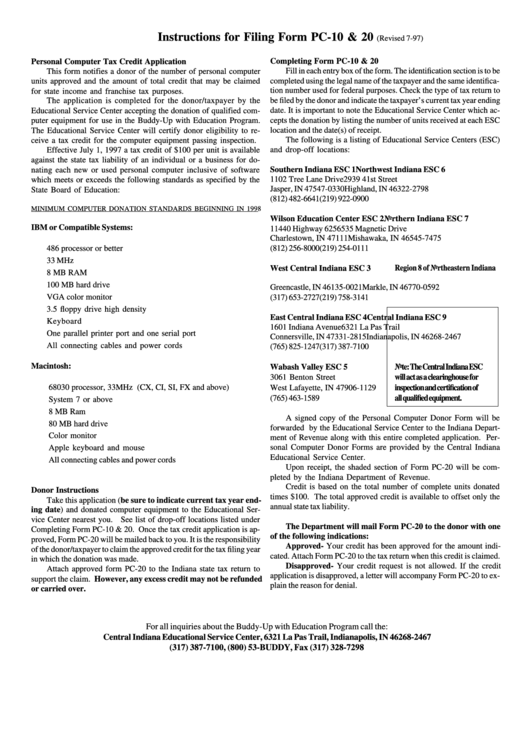

Instructions for Filing Form PC-10 & 20

(Revised 7-97)

Completing Form PC-10 & 20

Personal Computer Tax Credit Application

Fill in each entry box of the form. The identification section is to be

This form notifies a donor of the number of personal computer

completed using the legal name of the taxpayer and the same identifica-

units approved and the amount of total credit that may be claimed

tion number used for federal purposes. Check the type of tax return to

for state income and franchise tax purposes.

The application is completed for the donor/taxpayer by the

be filed by the donor and indicate the taxpayer’s current tax year ending

date. It is important to note the Educational Service Center which ac-

Educational Service Center accepting the donation of qualified com-

cepts the donation by listing the number of units received at each ESC

puter equipment for use in the Buddy-Up with Education Program.

location and the date(s) of receipt.

The Educational Service Center will certify donor eligibility to re-

The following is a listing of Educational Service Centers (ESC)

ceive a tax credit for the computer equipment passing inspection.

and drop-off locations:

Effective July 1, 1997 a tax credit of $100 per unit is available

against the state tax liability of an individual or a business for do-

nating each new or used personal computer inclusive of software

Southern Indiana ESC 1

Northwest Indiana ESC 6

1102 Tree Lane Drive

2939 41st Street

which meets or exceeds the following standards as specified by the

Jasper, IN 47547-0330

Highland, IN 46322-2798

State Board of Education:

(812) 482-6641

(219) 922-0900

MINIMUM COMPUTER DONATION STANDARDS BEGINNING IN 1998

Wilson Education Center ESC 2

Northern Indiana ESC 7

IBM or Compatible Systems:

11440 Highway 62

56535 Magnetic Drive

Charlestown, IN 47111

Mishawaka, IN 46545-7475

486 processor or better

(812) 256-8000

(219) 254-0111

33 MHz

West Central Indiana ESC 3

Region 8 of Northeastern Indiana

8 MB RAM

P.O. Box 21

P.O. Box 259

100 MB hard drive

Greencastle, IN 46135-0021

Markle, IN 46770-0592

VGA color monitor

(317) 653-2727

(219) 758-3141

3.5 floppy drive high density

East Central Indiana ESC 4

Central Indiana ESC 9

Keyboard

1601 Indiana Avenue

6321 La Pas Trail

One parallel printer port and one serial port

Connersville, IN 47331-2815

Indianapolis, IN 46268-2467

All connecting cables and power cords

(765) 825-1247

(317) 387-7100

Macintosh:

Note: The Central Indiana ESC

Wabash Valley ESC 5

3061 Benton Street

will act as a clearinghouse for

68030 processor, 33MHz (CX, CI, SI, FX and above)

inspection and certification of

West Lafayette, IN 47906-1129

all qualified equipment.

(765) 463-1589

System 7 or above

8 MB Ram

A signed copy of the Personal Computer Donor Form will be

80 MB hard drive

forwarded by the Educational Service Center to the Indiana Depart-

Color monitor

ment of Revenue along with this entire completed application. Per-

sonal Computer Donor Forms are provided by the Central Indiana

Apple keyboard and mouse

Educational Service Center.

All connecting cables and power cords

Upon receipt, the shaded section of Form PC-20 will be com-

pleted by the Indiana Department of Revenue.

Credit is based on the total number of complete units donated

Donor Instructions

times $100. The total approved credit is available to offset only the

Take this application (be sure to indicate current tax year end-

annual state tax liability.

ing date) and donated computer equipment to the Educational Ser-

vice Center nearest you. See list of drop-off locations listed under

The Department will mail Form PC-20 to the donor with one

Completing Form PC-10 & 20. Once the tax credit application is ap-

of the following indications:

proved, Form PC-20 will be mailed back to you. It is the responsibility

Approved- Your credit has been approved for the amount indi-

of the donor/taxpayer to claim the approved credit for the tax filing year

cated. Attach Form PC-20 to the tax return when this credit is claimed.

in which the donation was made.

Disapproved- Your credit request is not allowed. If the credit

Attach approved form PC-20 to the Indiana state tax return to

application is disapproved, a letter will accompany Form PC-20 to ex-

support the claim. However, any excess credit may not be refunded

plain the reason for denial.

or carried over.

For all inquiries about the Buddy-Up with Education Program call the:

Central Indiana Educational Service Center, 6321 La Pas Trail, Indianapolis, IN 46268-2467

(317) 387-7100, (800) 53-BUDDY, Fax (317) 328-7298

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1