Instructions For Form 503

ADVERTISEMENT

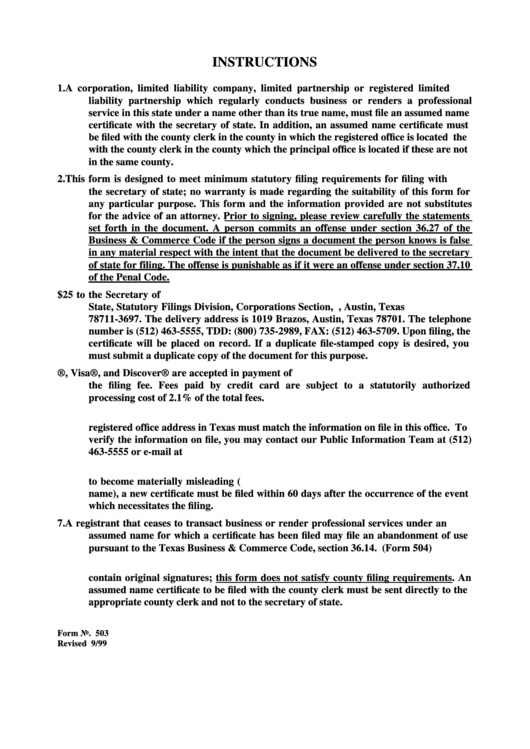

INSTRUCTIONS

1.

A corporation, limited liability company, limited partnership or registered limited

liability partnership which regularly conducts business or renders a professional

service in this state under a name other than its true name, must file an assumed name

certificate with the secretary of state. In addition, an assumed name certificate must

be filed with the county clerk in the county in which the registered office is located the

with the county clerk in the county which the principal office is located if these are not

in the same county.

2.

This form is designed to meet minimum statutory filing requirements for filing with

the secretary of state; no warranty is made regarding the suitability of this form for

any particular purpose. This form and the information provided are not substitutes

for the advice of an attorney. Prior to signing, please review carefully the statements

set forth in the document. A person commits an offense under section 36.27 of the

Business & Commerce Code if the person signs a document the person knows is false

in any material respect with the intent that the document be delivered to the secretary

of state for filing. The offense is punishable as if it were an offense under section 37.10

of the Penal Code.

3.

Send the executed certificate accompanied by the filing fee of $25 to the Secretary of

State, Statutory Filings Division, Corporations Section, P.O. Box 13697, Austin, Texas

78711-3697. The delivery address is 1019 Brazos, Austin, Texas 78701. The telephone

number is (512) 463-5555, TDD: (800) 735-2989, FAX: (512) 463-5709. Upon filing, the

certificate will be placed on record. If a duplicate file-stamped copy is desired, you

must submit a duplicate copy of the document for this purpose.

4.

Personal checks and MasterCard®, Visa®, and Discover® are accepted in payment of

the filing fee. Fees paid by credit card are subject to a statutorily authorized

processing cost of 2.1% of the total fees.

5.

The information provided in paragraph 6 regarding the registered agent and

registered office address in Texas must match the information on file in this office. To

verify the information on file, you may contact our Public Information Team at (512)

463-5555 or e-mail at corpinfo@sos.state.tx.us.

6.

Whenever an event occurs that causes the information in the assumed name certificate

to become materially misleading (e.g. change of registered agent/office or a change of

name), a new certificate must be filed within 60 days after the occurrence of the event

which necessitates the filing.

7.

A registrant that ceases to transact business or render professional services under an

assumed name for which a certificate has been filed may file an abandonment of use

pursuant to the Texas Business & Commerce Code, section 36.14. (Form 504)

8.

Assumed name certificates to be filed with the county clerk must be notarized and

contain original signatures; this form does not satisfy county filing requirements. An

assumed name certificate to be filed with the county clerk must be sent directly to the

appropriate county clerk and not to the secretary of state.

Form No. 503

Revised 9/99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1