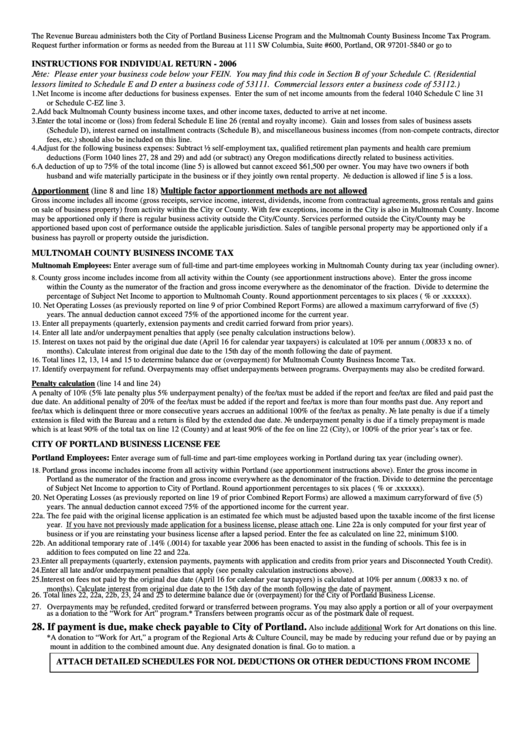

Instructions For Individual Return - 2006

ADVERTISEMENT

The Revenue Bureau administers both the City of Portland Business License Program and the Multnomah County Business Income Tax Program.

Request further information or forms as needed from the Bureau at 111 SW Columbia, Suite #600, Portland, OR 97201-5840 or go to

INSTRUCTIONS FOR INDIVIDUAL RETURN - 2006

Note: Please enter your business code below your FEIN. You may find this code in Section B of your Schedule C. (Residential

lessors limited to Schedule E and D enter a business code of 53111. Commercial lessors enter a business code of 53112.)

1.

Net Income is income after deductions for business expenses. Enter the sum of net income amounts from the federal 1040 Schedule C line 31

or Schedule C-EZ line 3.

2.

Add back Multnomah County business income taxes, and other income taxes, deducted to arrive at net income.

3.

Enter the total income or (loss) from federal Schedule E line 26 (rental and royalty income). Gain and losses from sales of business assets

(Schedule D), interest earned on installment contracts (Schedule B), and miscellaneous business incomes (from non-compete contracts, director

fees, etc.) should also be included on this line.

4.

Adjust for the following business expenses: Subtract ½ self-employment tax, qualified retirement plan payments and health care premium

deductions (Form 1040 lines 27, 28 and 29) and add (or subtract) any Oregon modifications directly related to business activities.

6.

A deduction of up to 75% of the total income (line 5) is allowed but cannot exceed $61,500 per owner. You may have two owners if both

husband and wife materially participate in the business or if they jointly own rental property. No deduction is allowed if line 5 is a loss.

Apportionment (line 8 and line 18) Multiple factor apportionment methods are not allowed

U

Gross income includes all income (gross receipts, service income, interest, dividends, income from contractual agreements, gross rentals and gains

on sale of business property) from activity within the City or County. With few exceptions, income in the City is also in Multnomah County. Income

may be apportioned only if there is regular business activity outside the City/County. Services performed outside the City/County may be

apportioned based upon cost of performance outside the applicable jurisdiction. Sales of tangible personal property may be apportioned only if a

.

business has payroll or property outside the jurisdiction

MULTNOMAH COUNTY BUSINESS INCOME TAX

Multnomah Employees: Enter average sum of full-time and part-time employees working in Multnomah County during tax year (including owner).

County gross income includes income from all activity within the County (see apportionment instructions above). Enter the gross income

8.

within the County as the numerator of the fraction and gross income everywhere as the denominator of the fraction. Divide to determine the

percentage of Subject Net Income to apportion to Multnomah County. Round apportionment percentages to six places (xx.xxxx% or .xxxxxx).

10. Net Operating Losses (as previously reported on line 9 of prior Combined Report Forms) are allowed a maximum carryforward of five (5)

years. The annual deduction cannot exceed 75% of the apportioned income for the current year.

Enter all prepayments (quarterly, extension payments and credit carried forward from prior years).

13.

Enter all late and/or underpayment penalties that apply (see penalty calculation instructions below).

14.

Interest on taxes not paid by the original due date (April 16 for calendar year taxpayers) is calculated at 10% per annum (.00833 x no. of

15.

months). Calculate interest from original due date to the 15th day of the month following the date of payment.

Total lines 12, 13, 14 and 15 to determine balance due or (overpayment) for Multnomah County Business Income Tax.

16.

Identify overpayment for refund. Overpayments may offset underpayments between programs. Overpayments may also be credited forward.

17.

Penalty calculation (line 14 and line 24)

A penalty of 10% (5% late penalty plus 5% underpayment penalty) of the fee/tax must be added if the report and fee/tax are filed and paid past the

due date. An additional penalty of 20% of the fee/tax must be added if the report and fee/tax is more than four months past due. Any report and

fee/tax which is delinquent three or more consecutive years accrues an additional 100% of the fee/tax as penalty. No late penalty is due if a timely

extension is filed with the Bureau and a return is filed by the extended due date. No underpayment penalty is due if a timely prepayment is made

w hich is at least 90% of the total tax on line 12 (County) and at least 90% of the fee on line 22 (City), or 100% of the prior year’s tax or fee.

CITY OF PORTLAND BUSINESS LICENSE FEE

Portland Employees:

Enter average sum of full-time and part-time employees working in Portland during tax year (including owner).

Portland gross income includes income from all activity within Portland (see apportionment instructions above). Enter the gross income in

18.

Portland as the numerator of the fraction and gross income everywhere as the denominator of the fraction. Divide to determine the percentage

of Subject Net Income to apportion to City of Portland. Round apportionment percentages to six places (xx.xxxx% or .xxxxxx).

20. Net Operating Losses (as previously reported on line 19 of prior Combined Report Forms) are allowed a maximum carryforward of five (5)

years. The annual deduction cannot exceed 75% of the apportioned income for the current year.

22a. The fee paid with the original license application is an estimated fee which must be adjusted based upon the taxable income of the first license

year. If you have not previously made application for a business license, please attach one. Line 22a is only computed for your first year of

business or if you are reinstating your business license after a lapsed period. Enter the fee as calculated on line 22, minimum $100.

22b. An additional temporary rate of .14% (.0014) for taxable year 2006 has been enacted to assist in the funding of schools. This fee is in

addition to fees computed on line 22 and 22a.

23. Enter all prepayments (quarterly, extension payments, payments with application and credits from prior years and Disconnected Youth Credit).

24. Enter all late and/or underpayment penalties that apply (see penalty calculation instructions above).

25. Interest on fees not paid by the original due date (April 16 for calendar year taxpayers) is calculated at 10% per annum (.00833 x no. of

months). Calculate interest from original due date to the 15th day of the month following the date of payment.

26. Total lines 22, 22a, 22b, 23, 24 and 25 to determine balance due or (overpayment) for the City of Portland Business License.

27. Overpayments may be refunded, credited forward or transferred between programs. You may also apply a portion or all of your overpayment

as a donation to the “Work for Art” program.* Transfers between programs occur as of the postmark date of request.

28. If payment is due, make check payable to City of Portland.

Also include additional Work for Art donations on this line.

*A donation to “Work for Art,” a program of the Regional Arts & Culture Council, may be made by reducing your refund due or by paying an

a

mount in addition to the combined amount due. Any designated donation is final. Go to www. for additional information.

ATTACH DETAILED SCHEDULES FOR NOL DEDUCTIONS OR OTHER DEDUCTIONS FROM INCOME

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2