Instructions For Real Property Petition Form - 2006

ADVERTISEMENT

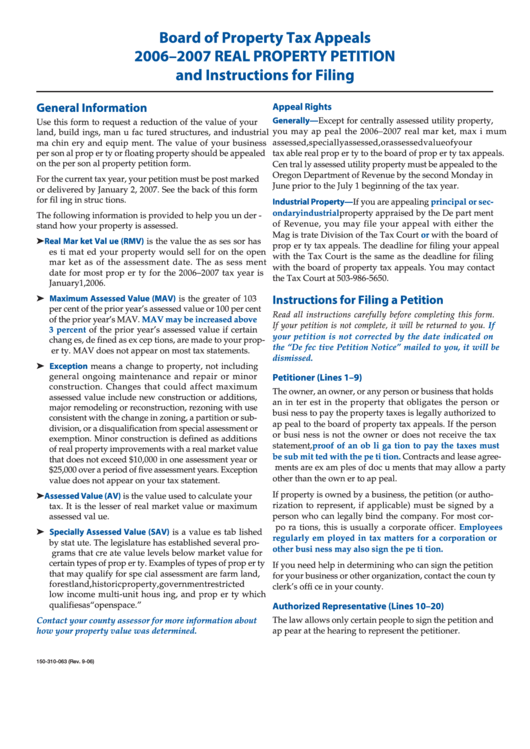

Board of Property Tax Appeals

2006–2007 REAL PROPERTY PETITION

and Instructions for Filing

General Information

Appeal Rights

Generally—Except for centrally assessed utility property,

Use this form to request a reduction of the value of your

you may ap peal the 2006–2007 real mar ket, max i mum

land, build ings, man u fac tured structures, and industrial

as sessed, spe cial ly as sessed, or as sessed value of your

ma chin ery and equip ment. The value of your business

per son al prop er ty or floating property should be appealed

tax able real prop er ty to the board of prop er ty tax appeals.

on the per son al property petition form.

Cen tral ly assessed utility property must be appealed to the

Oregon Department of Revenue by the second Monday in

For the current tax year, your petition must be post marked

June prior to the July 1 beginning of the tax year.

or delivered by January 2, 2007. See the back of this form

for fil ing in struc tions.

Industrial

Property—If you are appealing

principal or sec-

ond ary industrial

property appraised by the De part ment

The following information is provided to help you un der -

of Revenue, you may file your appeal with either the

stand how your property is assessed.

Mag is trate Division of the Tax Court

or

with the board of

➤

Real Mar ket Val ue (RMV)

is the value the as ses sor has

prop er ty tax appeals. The deadline for filing your appeal

es ti mat ed your property would sell for on the open

with the Tax Court is the same as the deadline for filing

mar ket as of the assessment date. The as sess ment

with the board of property tax appeals. You may contact

date for most prop er ty for the 2006–2007 tax year is

the Tax Court at 503-986-5650.

Jan u ary 1, 2006.

➤

is the greater of 103

Maximum Assessed Value (MAV)

Instructions for Filing a Petition

per cent of the prior year’s assessed value or 100 per cent

Read all instructions carefully before completing this form.

of the prior year’s MAV.

MAV may be increased above

If your petition is not complete, it will be returned to you.

If

3 percent

of the prior year’s assessed value if certain

your petition is not corrected by the date indicated on

chang es, de fined as ex cep tions, are made to your prop-

the “De fec tive Petition Notice” mailed to you, it will be

er ty. MAV does not appear on most tax statements.

dis missed.

➤

Exception

means a change to property, not including

general ongoing maintenance and repair or minor

Petitioner (Lines 1–9)

construction. Changes that could affect maximum

The owner, an owner, or any person or business that holds

assessed value include new construction or additions,

an in ter est in the property that obligates the person or

major remodeling or reconstruction, rezoning with use

busi ness to pay the property taxes is legally authorized to

consistent with the change in zoning, a partition or sub-

ap peal to the board of property tax appeals. If the person

division, or a disqualification from special assessment or

or busi ness is not the owner or does not receive the tax

exemption. Minor construction is defined as additions

state ment,

proof of an ob li ga tion to pay the taxes must

of real property improvements with a real market value

be sub mit ted with the pe ti tion.

Contracts and lease agree-

that does not exceed $10,000 in one assessment year or

ments are ex am ples of doc u ments that may allow a party

$25,000 over a period of five assessment years. Exception

other than the own er to ap peal.

value does not appear on your tax statement.

➤

If property is owned by a business, the petition (or autho-

Assessed Value (AV)

is the value used to calculate your

rization to represent, if applicable) must be signed by a

tax. It is the lesser of real market value or maximum

person who can legally bind the company. For most cor-

assessed val ue.

po ra tions, this is usually a corporate officer.

Employees

➤

Specially Assessed Value (SAV)

is a value es tab lished

regularly em ployed in tax matters for a corporation or

by stat ute. The legislature has established several pro-

other busi ness may also sign the pe ti tion.

grams that cre ate value levels below market value for

certain types of prop er ty. Examples of types of prop er ty

If you need help in determining who can sign the petition

that may qualify for spe cial assessment are farm land,

for your business or other organization, contact the coun ty

for est land, historic prop er ty, government restricted

clerk’s offi ce in your county.

low income multi-unit hous ing, and prop er ty which

qual i fies as “open space.”

Authorized Representative (Lines 10–20)

The law allows only certain people to sign the petition and

Contact your county assessor for more information about

how your property value was determined.

ap pear at the hearing to represent the petitioner.

150-310-063 (Rev. 9-06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2