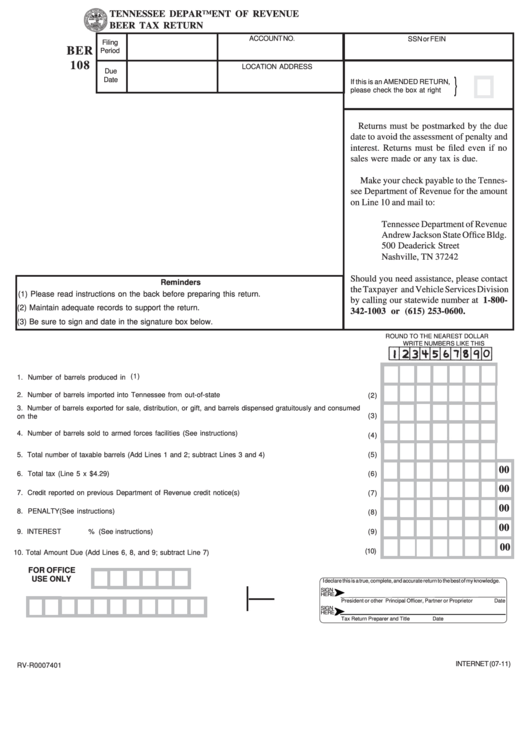

Form Ber 108 - Tennessee Department Of Revenue Beer Tax Return July 2011

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

BEER TAX RETURN

ACCOUNT NO.

SSN or FEIN

Filing

BER

Period

108

LOCATION ADDRESS

Due

Date

}

If this is an AMENDED RETURN,

please check the box at right

Returns must be postmarked by the due

date to avoid the assessment of penalty and

interest. Returns must be filed even if no

sales were made or any tax is due.

Make your check payable to the Tennes-

see Department of Revenue for the amount

on Line 10 and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

500 Deaderick Street

Nashville, TN 37242

Should you need assistance, please contact

Reminders

the Taxpayer and Vehicle Services Division

(1) Please read instructions on the back before preparing this return.

by calling our statewide number at 1-800-

(2) Maintain adequate records to support the return.

342-1003 or (615) 253-0600.

(3) Be sure to sign and date in the signature box below.

ROUND TO THE NEAREST DOLLAR

WRITE NUMBERS LIKE THIS

1. Number of barrels produced in Tennessee........................................................................................................ (1)

2. Number of barrels imported into Tennessee from out-of-state suppliers...........................................................

(2)

3. Number of barrels exported for sale, distribution, or gift, and barrels dispensed gratuitously and consumed

(3)

on the premises.................................................................................................................................................

4. Number of barrels sold to armed forces facilities (See instructions)................................................................

(4)

(5)

5. Total number of taxable barrels (Add Lines 1 and 2; subtract Lines 3 and 4)..................................................

00

6. Total tax (Line 5 x $4.29)...................................................................................................................................

(6)

00

7. Credit reported on previous Department of Revenue credit notice(s)...............................................................

(7)

00

8. PENALTY (See instructions).............................................................................................................................

(8)

00

9. INTEREST

% (See instructions)..........................................................................................................

(9)

00

(10)

10. Total Amount Due (Add Lines 6, 8, and 9; subtract Line 7)..............................................................................

FOR OFFICE

USE ONLY

I declare this is a true, complete, and accurate return to the best of my knowledge.

SIGN

HERE

President or other Principal Officer, Partner or Proprietor

Date

SIGN

HERE

Tax Return Preparer and Title

Date

INTERNET (07-11)

RV-R0007401

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2