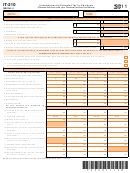

Instructions For Form It-210 - Underpayment Of Estimated Tax By Individuals - 2006

ADVERTISEMENT

UNDERPAYMENT OF ESTIMATED TAX BY INDIVIDUALS - 2006

IT 210

DISCLAIMER:

The IT-210 self calculating fill-in form "Underpayment of Estimated Tax by Individuals"

is designed to assist Taxpayers in calculating the penalty due for underpayment of

estimated personal income tax. Computation of these amounts is based on application of

the law to the facts as finally determined. Correct information is crucial in making an

accurate calculation.

You should not use this self calculating form if you have multiple payments made on

different dates for any quarter or if the payment(s) made in any succeeding quarter fail to

pay the previous quarter underpayment in full. In these situations, you will need to make

more than one calculation for each quarter that meets this criterion. Those calculations

must be done manually or by the Tax Department.

If you remit the penalty to the State Tax Department based on use of this self calculating

form and it is later determined that additional penalty is due, the Department will issue to

you a notice for the additional amount due.

If you have any questions concerning this IT-210 Underpayment of Estimated Tax by

Individuals self calculating form, please call (304) 558-3333 or 1-800-982-8297.

Print Disclaimer

Click Here to Complete the Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4