Form Ri-2642 - Computation Of Small Business Tax Credit - 2003

ADVERTISEMENT

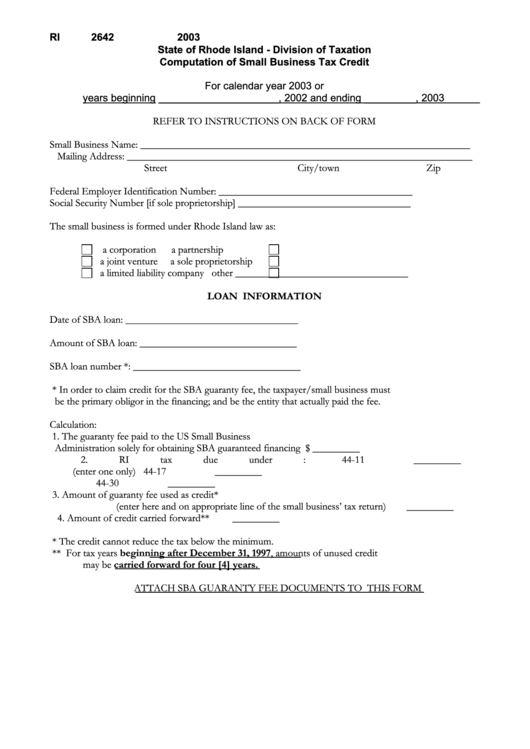

RI 2642

2003

State of Rhode Island - Division of Taxation

Computation of Small Business Tax Credit

For calendar year 2003 or

years beginning _____________________, 2002 and ending _________, 2003

REFER TO INSTRUCTIONS ON BACK OF FORM

Small Business Name: _______________________________________________________________

Mailing Address: __________________________________________________________________

Street

City/town

Zip

Federal Employer Identification Number: _____________________________________

Social Security Number [if sole proprietorship] _________________________________

The small business is formed under Rhode Island law as:

a corporation

a partnership

a joint venture

a sole proprietorship

a limited liability company

other _________________________________

LOAN INFORMATION

Date of SBA loan: _________________________________

Amount of SBA loan: ______________________________

SBA loan number *: ________________________________

* In order to claim credit for the SBA guaranty fee, the taxpayer/small business

must

be the primary obligor in the financing; and be the entity that actually paid the fee.

Calculation:

1.

The guaranty fee paid to the US Small Business

Administration solely for obtaining SBA guaranteed financing

$ _________

2.

RI tax due under :

44-11

_________

(enter one only)

44-17

_________

44-30

_________

3.

Amount of guaranty fee used as credit*

(enter here and on appropriate line of the small business’ tax return)

_________

4.

Amount of credit carried forward**

_________

* The credit cannot reduce the tax below the minimum.

** For tax years beginning after December 31, 1997, amounts of unused credit

may be carried forward for four [4] years.

ATTACH SBA GUARANTY FEE DOCUMENTS TO THIS FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1