Instructions For Form 1041 - Schedule G

ADVERTISEMENT

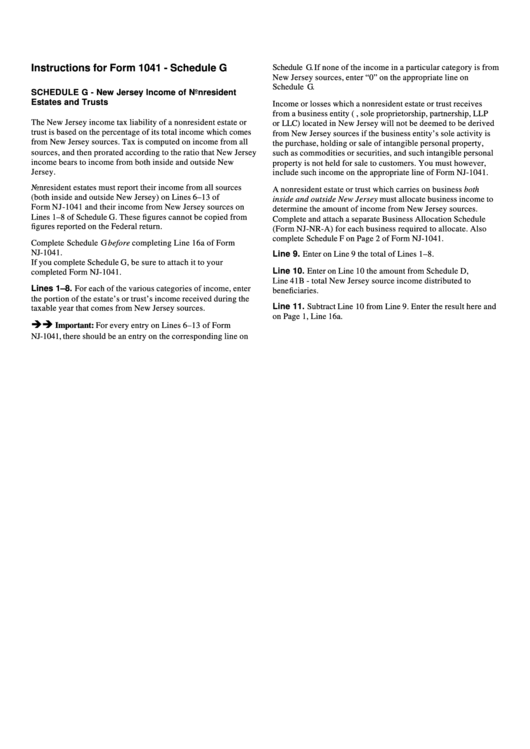

Instructions for Form 1041 - Schedule G

Schedule G. If none of the income in a particular category is from

New Jersey sources, enter “0” on the appropriate line on

Schedule G.

SCHEDULE G - New Jersey Income of Nonresident

Estates and Trusts

Income or losses which a nonresident estate or trust receives

from a business entity (i.e., sole proprietorship, partnership, LLP

The New Jersey income tax liability of a nonresident estate or

or LLC) located in New Jersey will not be deemed to be derived

trust is based on the percentage of its total income which comes

from New Jersey sources if the business entity’s sole activity is

from New Jersey sources. Tax is computed on income from all

the purchase, holding or sale of intangible personal property,

sources, and then prorated according to the ratio that New Jersey

such as commodities or securities, and such intangible personal

income bears to income from both inside and outside New

property is not held for sale to customers. You must however,

Jersey.

include such income on the appropriate line of Form NJ-1041.

Nonresident estates must report their income from all sources

A nonresident estate or trust which carries on business both

(both inside and outside New Jersey) on Lines 6–13 of

inside and outside New Jersey must allocate business income to

Form NJ-1041 and their income from New Jersey sources on

determine the amount of income from New Jersey sources.

Lines 1–8 of Schedule G. These figures cannot be copied from

Complete and attach a separate Business Allocation Schedule

figures reported on the Federal return.

(Form NJ-NR-A) for each business required to allocate. Also

complete Schedule F on Page 2 of Form NJ-1041.

Complete Schedule G before completing Line 16a of Form

NJ-1041.

Line 9. Enter on Line 9 the total of Lines 1–8.

If you complete Schedule G, be sure to attach it to your

Line 10. Enter on Line 10 the amount from Schedule D,

completed Form NJ-1041.

Line 41B - total New Jersey source income distributed to

Lines 1–8. For each of the various categories of income, enter

beneficiaries.

the portion of the estate’s or trust’s income received during the

Line 11. Subtract Line 10 from Line 9. Enter the result here and

taxable year that comes from New Jersey sources.

on Page 1, Line 16a.

è

è

Important:

For every entry on Lines 6–13 of Form

NJ-1041, there should be an entry on the corresponding line on

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2