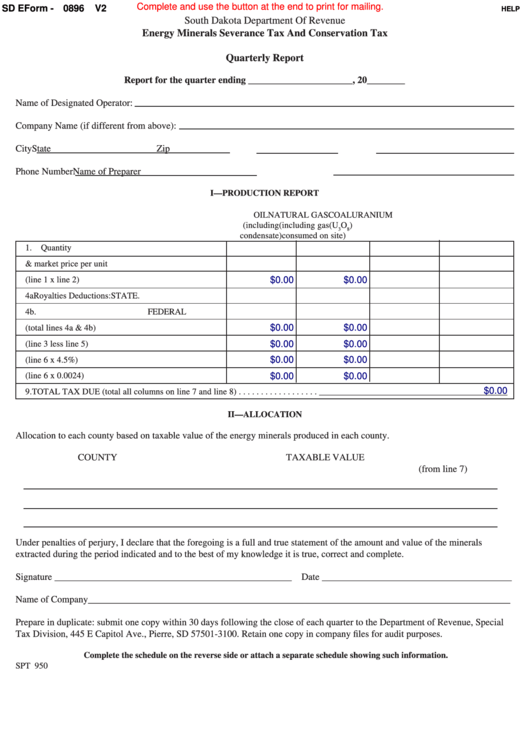

Complete and use the button at the end to print for mailing.

SD EForm - 0896

V2

HELP

South Dakota Department Of Revenue

Energy Minerals Severance Tax And Conservation Tax

Quarterly Report

Report for the quarter ending ______________________, 20________

Name of Designated Operator:

Company Name (if different from above):

City

State

Zip

Phone Number

Name of Preparer

I—PRODUCTION REPORT

OIL

NATURAL GAS

COAL

URANIUM

(including

(including gas

(U

O

)

3

8

condensate)

consumed on site)

1. Quantity

2. Average posted field & market price per unit

3. Gross value (line 1 x line 2)

$0.00

$0.00

4a Royalties Deductions:

STATE

.

4b.

FEDERAL

$0.00

$0.00

5. Total deductions (total lines 4a & 4b)

$0.00

$0.00

6. Taxable value (line 3 less line 5)

$0.00

$0.00

7. Severance tax due (line 6 x 4.5%)

$0.00

$0.00

8. Conservation tax due (line 6 x 0.0024)

$0.00

9. TOTAL TAX DUE (total all columns on line 7 and line 8) . . . . . . . . . . . . . . . . . . ___________________________________________

II—ALLOCATION

Allocation to each county based on taxable value of the energy minerals produced in each county.

COUNTY

TAXABLE VALUE

SEVERANCE TAX DUE

(from line 7)

Under penalties of perjury, I declare that the foregoing is a full and true statement of the amount and value of the minerals

extracted during the period indicated and to the best of my knowledge it is true, correct and complete.

Signature __________________________________________________ Date ________________________________________

Name of Company_________________________________________________________________________________________

Prepare in duplicate: submit one copy within 30 days following the close of each quarter to the Department of Revenue, Special

Tax Division, 445 E Capitol Ave., Pierre, SD 57501-3100. Retain one copy in company files for audit purposes.

Complete the schedule on the reverse side or attach a separate schedule showing such information.

SPT 950

1

1 2

2