Shedule Tcsp-40 Form - Twenty-First Century Scholars Program Credit - 2003

ADVERTISEMENT

Attachment

Schedule

Twenty-First Century Scholars

13

TCSP- 40

Sequence No.

Program Credit for the Year ______

SF 47335

8/03

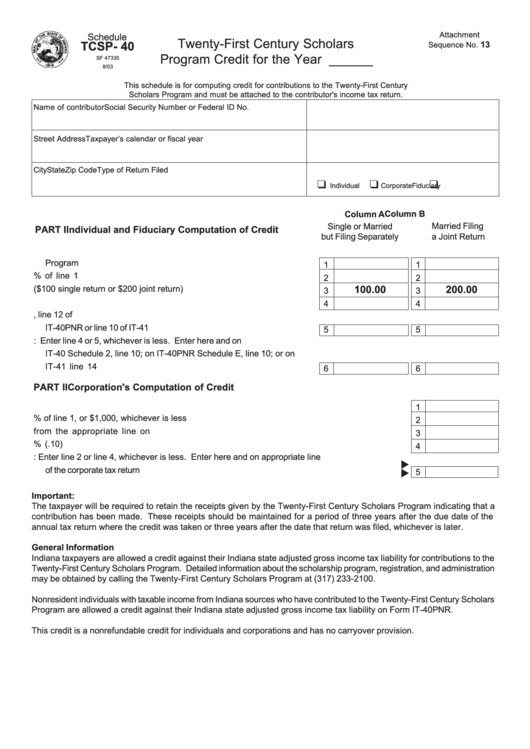

This schedule is for computing credit for contributions to the Twenty-First Century

Scholars Program and must be attached to the contributor's income tax return.

Name of contributor

Social Security Number or Federal ID No.

Street Address

Taxpayer’s calendar or fiscal year

City

State

Zip Code

Type of Return Filed

Individual

Corporate

Fiduciary

Column B

Column A

Married Filing

Single or Married

PART I

Individual and Fiduciary Computation of Credit

but Filing Separately

a Joint Return

1. Enter the total contributions to the Twenty-First Century Scholars

Program ...............................................................................................

1

1

2. Enter 50% of line 1 ...........................................................................

2

2

3. Limitation ($100 single return or $200 joint return) ................................

100.00

200.00

3

3

4. Enter the lesser of line 2 or line 3 .......................................................

4

4

5. Enter Indiana adjusted gross income tax from line 15 of IT-40, line 12 of

IT-40PNR or line 10 of IT-41 ......................................................................

5

5

6. Allowable Credit: Enter line 4 or 5, whichever is less. Enter here and on

IT-40 Schedule 2, line 10; on IT-40PNR Schedule E, line 10; or on

IT-41 line 14 .....................................................................................

6

6

PART II

Corporation's Computation of Credit

1. Enter the total contributions to the Twenty-First Century Scholars Program ..........................

1

2. Enter 50% of line 1, or $1,000, whichever is less ....................................................................

2

3. Enter the adjusted gross income tax from the appropriate line on IT-20.....................

3

4. Multiply line 3 by 10% (.10) ...................................................................................................

4

5. CREDIT: Enter line 2 or line 4, whichever is less. Enter here and on appropriate line

of the corporate tax return ...............................................................................................................

5

Important:

The taxpayer will be required to retain the receipts given by the Twenty-First Century Scholars Program indicating that a

contribution has been made. These receipts should be maintained for a period of three years after the due date of the

annual tax return where the credit was taken or three years after the date that return was filed, whichever is later.

General Information

Indiana taxpayers are allowed a credit against their Indiana state adjusted gross income tax liability for contributions to the

Twenty-First Century Scholars Program. Detailed information about the scholarship program, registration, and administration

may be obtained by calling the Twenty-First Century Scholars Program at (317) 233-2100.

Nonresident individuals with taxable income from Indiana sources who have contributed to the Twenty-First Century Scholars

Program are allowed a credit against their Indiana state adjusted gross income tax liability on Form IT-40PNR.

This credit is a nonrefundable credit for individuals and corporations and has no carryover provision.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1