Instructions For Form 1120-Sf - U.s. Income Tax Return For Settlement Funds - 2011

ADVERTISEMENT

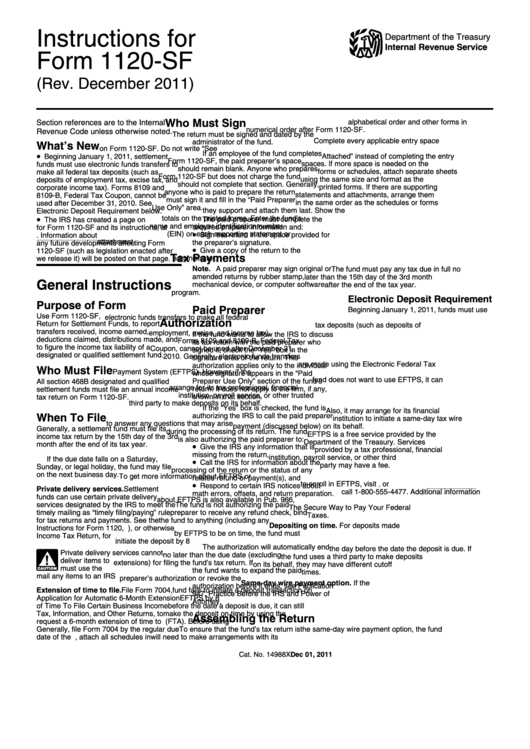

Instructions for

Department of the Treasury

Internal Revenue Service

Form 1120-SF

(Rev. December 2011)

U.S. Income Tax Return for Settlement Funds

Who Must Sign

alphabetical order and other forms in

Section references are to the Internal

numerical order after Form 1120-SF.

Revenue Code unless otherwise noted.

The return must be signed and dated by the

Complete every applicable entry space

administrator of the fund.

What’s New

on Form 1120-SF. Do not write “See

If an employee of the fund completes

•

Attached” instead of completing the entry

Beginning January 1, 2011, settlement

Form 1120-SF, the paid preparer’s space

spaces. If more space is needed on the

funds must use electronic funds transfers to

should remain blank. Anyone who prepares

forms or schedules, attach separate sheets

make all federal tax deposits (such as

Form 1120-SF but does not charge the fund

using the same size and format as the

deposits of employment tax, excise tax, and

should not complete that section. Generally,

printed forms. If there are supporting

corporate income tax). Forms 8109 and

anyone who is paid to prepare the return

statements and attachments, arrange them

8109-B, Federal Tax Coupon, cannot be

must sign it and fill in the “Paid Preparer

in the same order as the schedules or forms

used after December 31, 2010. See

Use Only” area.

they support and attach them last. Show the

Electronic Deposit Requirement below.

•

totals on the printed forms. Enter the fund’s

The paid preparer must complete the

The IRS has created a page on IRS.gov

name and employer identification number

required preparer information and:

for Form 1120-SF and its instructions, at

•

(EIN) on each supporting statement or

Sign the return in the space provided for

Information about

attachment.

the preparer’s signature.

any future developments affecting Form

•

Give a copy of the return to the

1120-SF (such as legislation enacted after

Tax Payments

administrator.

we release it) will be posted on that page.

Note. A paid preparer may sign original or

The fund must pay any tax due in full no

amended returns by rubber stamp,

later than the 15th day of the 3rd month

General Instructions

mechanical device, or computer software

after the end of the tax year.

program.

Electronic Deposit Requirement

Purpose of Form

Paid Preparer

Beginning January 1, 2011, funds must use

Use Form 1120-SF, U.S. Income Tax

electronic funds transfers to make all federal

Authorization

Return for Settlement Funds, to report

tax deposits (such as deposits of

transfers received, income earned,

employment, excise, and income tax).

If the fund wants to allow the IRS to discuss

deductions claimed, distributions made, and

Forms 8109 and 8109-B, Federal Tax

its tax return with the paid preparer who

to figure the income tax liability of a

Coupon, cannot be used after December 31,

signed it, check the “Yes” box in the

designated or qualified settlement fund.

2010. Generally, electronic funds transfers

signature area of the return. This

are made using the Electronic Federal Tax

authorization applies only to the individual

Who Must File

Payment System (EFTPS). However, if the

whose signature appears in the “Paid

fund does not want to use EFTPS, it can

Preparer Use Only” section of the fund’s

All section 468B designated and qualified

arrange for its tax professional, financial

return. It does not apply to the firm, if any,

settlement funds must file an annual income

institution, payroll service, or other trusted

shown in that section.

tax return on Form 1120-SF.

third party to make deposits on its behalf.

If the “Yes” box is checked, the fund is

Also, it may arrange for its financial

When To File

authorizing the IRS to call the paid preparer

institution to initiate a same-day tax wire

to answer any questions that may arise

payment (discussed below) on its behalf.

Generally, a settlement fund must file its

during the processing of its return. The fund

EFTPS is a free service provided by the

income tax return by the 15th day of the 3rd

is also authorizing the paid preparer to:

Department of the Treasury. Services

month after the end of its tax year.

•

Give the IRS any information that is

provided by a tax professional, financial

missing from the return,

institution, payroll service, or other third

If the due date falls on a Saturday,

•

Call the IRS for information about the

party may have a fee.

Sunday, or legal holiday, the fund may file

processing of the return or the status of any

on the next business day.

To get more information about EFTPS or

related refund or payment(s), and

•

to enroll in EFTPS, visit

,

or

Respond to certain IRS notices about

Private delivery services. Settlement

call 1-800-555-4477. Additional information

math errors, offsets, and return preparation.

funds can use certain private delivery

about EFTPS is also available in Pub. 966,

services designated by the IRS to meet the

The fund is not authorizing the paid

The Secure Way to Pay Your Federal

timely mailing as “timely filing/paying” rule

preparer to receive any refund check, bind

Taxes.

for tax returns and payments. See the

the fund to anything (including any

Depositing on time. For deposits made

Instructions for Form 1120, U.S. Corporation

additional tax liability), or otherwise

by EFTPS to be on time, the fund must

Income Tax Return, for details.

represent the fund before the IRS.

initiate the deposit by 8 p.m. Eastern time

The authorization will automatically end

the day before the date the deposit is due. If

Private delivery services cannot

no later than the due date (excluding

the fund uses a third party to make deposits

!

deliver items to P.O. boxes. The fund

extensions) for filing the fund’s tax return. If

on its behalf, they may have different cutoff

must use the U.S. Postal Service to

the fund wants to expand the paid

CAUTION

times.

mail any items to an IRS P.O. box address.

preparer’s authorization or revoke the

Same-day wire payment option. If the

authorization before it ends, see Publication

Extension of time to file. File Form 7004,

fund fails to initiate a deposit transaction on

947, Practice Before the IRS and Power of

Application for Automatic 6-Month Extension

EFTPS by 8 p.m. Eastern time the day

Attorney.

of Time To File Certain Business Income

before the date a deposit is due, it can still

Tax, Information, and Other Returns, to

make the deposit on time by using the

Assembling the Return

request a 6-month extension of time to file.

Federal Tax Application (FTA). Before using

Generally, file Form 7004 by the regular due

To ensure that the fund’s tax return is

the same-day wire payment option, the fund

date of the return.

processed correctly, attach all schedules in

will need to make arrangements with its

Dec 01, 2011

Cat. No. 14988X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4