Reset Form

Print Form

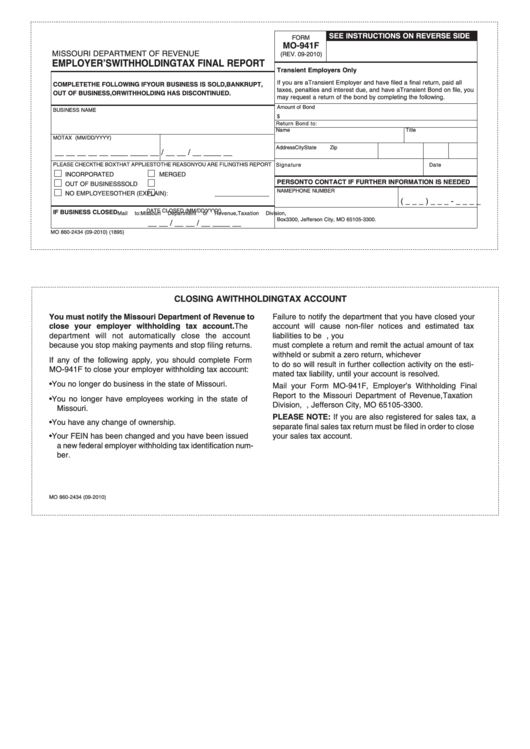

SEE INSTRUCTIONS ON REVERSE SIDE

FORM

MO-941F

MISSOURI DEPARTMENT OF REVENUE

(REV. 09-2010)

EMPLOYER’S WITHHOLDING TAX FINAL REPORT

Transient Employers Only

If you are a Transient Employer and have filed a final return, paid all

COMPLETE THE FOLLOWING IF YOUR BUSINESS IS SOLD, BANKRUPT,

taxes, penalties and interest due, and have a Transient Bond on file, you

OUT OF BUSINESS, OR WITHHOLDING HAS DISCONTINUED.

may request a return of the bond by completing the following.

Amount of Bond

BUSINESS NAME

$

Return Bond to:

Name

Title

MO TAX I.D. NUMBER

DATE OF LAST PAYROLL (MM/DD/YYYY)

Address

City

State

Zip

__ __ __ __ __ __ __ __

__ __ / __ __ / __ __ __ __

PLEASE CHECK THE BOX THAT APPLIES TO THE REASON YOU ARE FILING THIS REPORT

Signature

Date

INCORPORATED

MERGED

PERSON TO CONTACT IF FURTHER INFORMATION IS NEEDED

OUT OF BUSINESS

SOLD

NAME

PHONE NUMBER

NO EMPLOYEES

OTHER (EXPLAIN):

(_ _ _) _ _ _ - _ _ _ _

DATE CLOSED (MM/DD/YYYY)

IF BUSINESS CLOSED

Mail

to:

Missouri

Department

of

Revenue,

Taxation

Division,

P.O.

Box 3300, Jefferson City, MO 65105-3300.

__ __ / __ __ / __ __ __ __

MO 860-2434 (09-2010) 1895)

CLOSING A WITHHOLDING TAX ACCOUNT

You must notify the Missouri Department of Revenue to

Failure to notify the department that you have closed your

close your employer withholding tax account. The

account will cause non-filer notices and estimated tax

department will not automatically close the account

liabilities to be issued. If you receive a non-filer notice, you

because you stop making payments and stop filing returns.

must complete a return and remit the actual amount of tax

withheld or submit a zero return, whichever applies. Failure

If any of the following apply, you should complete Form

to do so will result in further collection activity on the esti-

MO-941F to close your employer withholding tax account:

mated tax liability, until your account is resolved.

• You no longer do business in the state of Missouri.

Mail your Form MO-941F, Employer’s Withholding Final

Report to the Missouri Department of Revenue, Taxation

• You no longer have employees working in the state of

Division, P.O. Box 3300, Jefferson City, MO 65105-3300.

Missouri.

PLEASE NOTE: If you are also registered for sales tax, a

• You have any change of ownership.

separate final sales tax return must be filed in order to close

• Your FEIN has been changed and you have been issued

your sales tax account.

a new federal employer withholding tax identification num-

ber.

MO 860-2434 (09-2010)

1

1