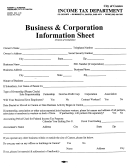

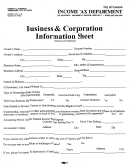

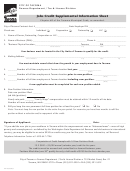

Business Information Sheet - City Of Stow

ADVERTISEMENT

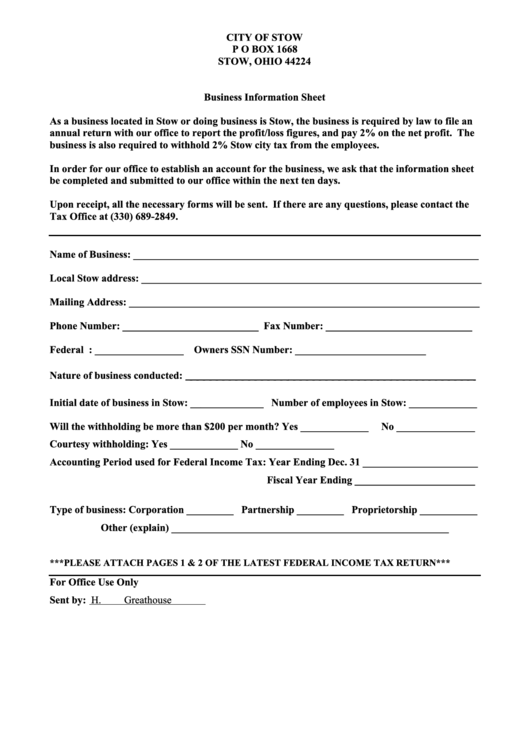

CITY OF STOW

P O BOX 1668

STOW, OHIO 44224

Business Information Sheet

As a business located in Stow or doing business is Stow, the business is required by law to file an

annual return with our office to report the profit/loss figures, and pay 2% on the net profit. The

business is also required to withhold 2% Stow city tax from the employees.

In order for our office to establish an account for the business, we ask that the information sheet

be completed and submitted to our office within the next ten days.

Upon receipt, all the necessary forms will be sent. If there are any questions, please contact the

Tax Office at (330) 689-2849.

Name of Business: __________________________________________________________________

Local Stow address: _________________________________________________________________

Mailing Address: ___________________________________________________________________

Phone Number: __________________________

Fax Number: ____________________________

Federal I.D. Number: _________________ Owners SSN Number: _________________________

Nature of business conducted: _____________________________________________

Initial date of business in Stow: ______________ Number of employees in Stow: _____________

Will the withholding be more than $200 per month? Yes _____________

No _______________

Courtesy withholding: Yes _____________

No _______________

Accounting Period used for Federal Income Tax: Year Ending Dec. 31 ______________________

Fiscal Year Ending _______________________

Type of business: Corporation _________ Partnership _________ Proprietorship ___________

Other (explain) _____________________________________________________

***PLEASE ATTACH PAGES 1 & 2 OF THE LATEST FEDERAL INCOME TAX RETURN***

For Office Use Only

Sent by:

H. Greathouse

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1