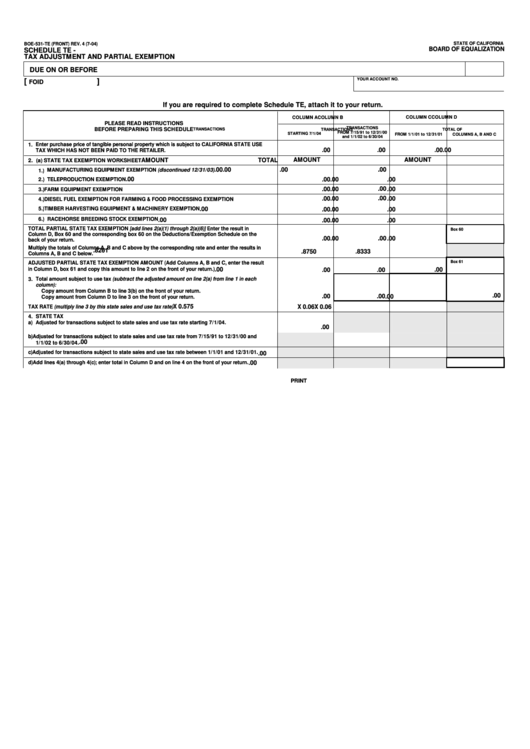

STATE OF CALIFORNIA

BOE-531-TE (FRONT) REV. 4 (7-04)

BOARD OF EQUALIZATION

SCHEDULE TE -

TAX ADJUSTMENT AND PARTIAL EXEMPTION

DUE ON OR BEFORE

[

]

YOUR ACCOUNT NO.

FOID

If you are required to complete Schedule TE, attach it to your return.

COLUMN C

COLUMN D

COLUMN A

COLUMN B

PLEASE READ INSTRUCTIONS

TRANSACTIONS

BEFORE PREPARING THIS SCHEDULE

TRANSACTIONS

TRANSACTIONS

TOTAL OF

FROM 7/15/91 to 12/31/00

STARTING 7/1/04

FROM 1/1/01 to 12/31/01

COLUMNS A, B AND C

and 1/1/02 to 6/30/04

1.

Enter purchase price of tangible personal property which is subject to CALIFORNIA STATE USE

.00

.00

.00

.00

TAX WHICH HAS NOT BEEN PAID TO THE RETAILER.

AMOUNT

AMOUNT

AMOUNT

TOTAL

2. (a) STATE TAX EXEMPTION WORKSHEET

.00

.00

.00

.00

MANUFACTURING EQUIPMENT EXEMPTION (discontinued 12/31/03)

1.)

.00

2.) TELEPRODUCTION EXEMPTION

.00

.00

.00

.00

.00

.00

.00

3.) FARM EQUIPMENT EXEMPTION

.00

.00

.00

.00

4.) DIESEL FUEL EXEMPTION FOR FARMING & FOOD PROCESSING EXEMPTION

5.) TIMBER HARVESTING EQUIPMENT & MACHINERY EXEMPTION

.00

.00

.00

.00

6.) RACEHORSE BREEDING STOCK EXEMPTION

.00

.00

.00

.00

TOTAL PARTIAL STATE TAX EXEMPTION [add lines 2(a)(1) through 2(a)(6)] Enter the result in

Box 60

Column D, Box 60 and the corresponding box 60 on the Deductions/Exemption Schedule on the

.00

.00

.00

.00

back of your return.

Multiply the totals of Columns A, B and C above by the corresponding rate and enter the results in

.8261

.8333

.8750

Columns A, B and C below.

Box 61

ADJUSTED PARTIAL STATE TAX EXEMPTION AMOUNT (Add Columns A, B and C, enter the result

in Column D, box 61 and copy this amount to line 2 on the front of your return.)

.00

.00

.00

.00

Total amount subject to use tax (subtract the adjusted amount on line 2(a) from line 1 in each

3.

column):

Copy amount from Column B to line 3(b) on the front of your return.

.00

.00

.00

.00

Copy amount from Column D to line 3 on the front of your return.

X 0.06

X 0.06

X 0.575

TAX RATE (multiply line 3 by this state sales and use tax rate)

STATE TAX

4.

Adjusted for transactions subject to state sales and use tax rate starting 7/1/04.

a)

.00

b) Adjusted for transactions subject to state sales and use tax rate from 7/15/91 to 12/31/00 and

.00

1/1/02 to 6/30/04.

c) Adjusted for transactions subject to state sales and use tax rate between 1/1/01 and 12/31/01.

.00

.00

d) Add lines 4(a) through 4(c); enter total in Column D and on line 4 on the front of your return.

CLEAR

PRINT

1

1