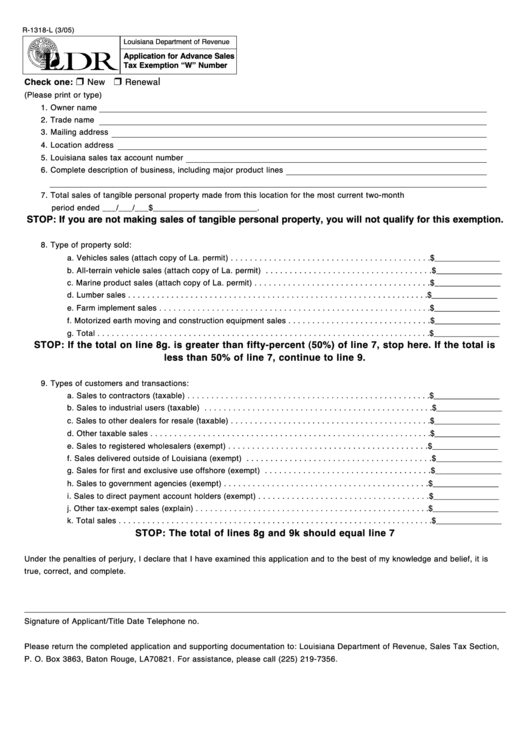

R-1318-L (3/05)

Louisiana Department of Revenue

Application for Advance Sales

Tax Exemption “W” Number

Ì

Ì

l

Check one:

New

Renewa

(Please print or type)

1. Owner name

2. Trade name

3. Mailing address

4. Location address

5. Louisiana sales tax account number

6. Complete description of business, including major product lines

7. Total sales of tangible personal property made from this location for the most current two-month

period ended ___/___/___ $________________________.

STOP: If you are not making sales of tangible personal property, you will not qualify for this exemption.

8. Type of property sold:

a. Vehicles sales (attach copy of La. permit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

b. All-terrain vehicle sales (attach copy of La. permit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

c. Marine product sales (attach copy of La. permit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

d. Lumber sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

e. Farm implement sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

f. Motorized earth moving and construction equipment sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

g. Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

STOP: If the total on line 8g. is greater than fifty-percent (50%) of line 7, stop here. If the total is

less than 50% of line 7, continue to line 9.

9. Types of customers and transactions:

a. Sales to contractors (taxable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

b. Sales to industrial users (taxable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

c. Sales to other dealers for resale (taxable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

d. Other taxable sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

e. Sales to registered wholesalers (exempt) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

f. Sales delivered outside of Louisiana (exempt) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

g. Sales for first and exclusive use offshore (exempt) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

h. Sales to government agencies (exempt) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

i. Sales to direct payment account holders (exempt) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

j. Other tax-exempt sales (explain) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

k. Total sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________

STOP: The total of lines 8g and 9k should equal line 7

Under the penalties of perjury, I declare that I have examined this application and to the best of my knowledge and belief, it is

true, correct, and complete.

______________________________________________________________________________________________________________

Signature of Applicant/Title

Date

Telephone no.

Please return the completed application and supporting documentation to: Louisiana Department of Revenue, Sales Tax Section,

P. O. Box 3863, Baton Rouge, LA 70821. For assistance, please call (225) 219-7356.

1

1