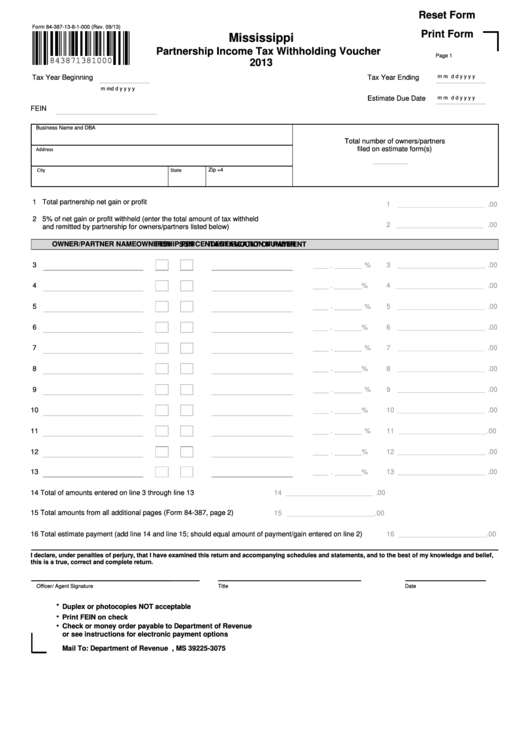

Reset Form

Form 84-387-13-8-1-000 (Rev. 09/13)

Print Form

Mississippi

Partnership Income Tax Withholding Voucher

Page 1

843871381000

2013

Tax Year Beginning

Tax Year Ending

m m d d

y y y y

m m d d

y y y y

Estimate Due Date

FEIN

m m d d

y y y y

Business Name and DBA

Total number of owners/partners

filed on estimate form(s)

Address

_________

City

State

Zip +4

1 Total partnership net gain or profit

1

.00

_____________________________

2 5% of net gain or profit withheld (enter the total amount of tax withheld

2

.00

_____________________________

and remitted by partnership for owners/partners listed below)

OWNER/PARTNER NAME

FEIN

SSN

IDENTIFICATION NUMBER

OWNERSHIP PERCENTAGE

AMOUNT OF PAYMENT

3

____ . _______

%

3

.00

_____________________________

4

____ . _______

%

4

.00

_____________________________

5

____ . _______

%

5

.00

_____________________________

6

____ . _______

%

6

.00

_____________________________

7

____ . _______

%

7

.00

_____________________________

8

____ . _______

%

8

.00

_____________________________

9

____ . _______

%

9

.00

_____________________________

10

____ . _______

%

10

.00

_____________________________

11

____ . _______

%

11

.00

_____________________________

12

____ . _______

%

12

.00

_____________________________

13

____ . _______

%

13

.00

_____________________________

14 Total of amounts entered on line 3 through line 13

14

.00

_____________________________

15 Total amounts from all additional pages (Form 84-387, page 2)

15

.00

_____________________________

16 Total estimate payment (add line 14 and line 15; should equal amount of payment/gain entered on line 2)

16

.00

_____________________________

I declare, under penalties of perjury, that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

this is a true, correct and complete return.

Officer/ Agent Signature

Title

Date

Duplex or photocopies NOT acceptable

Print FEIN on check

Check or money order payable to Department of Revenue

or see instructions for electronic payment options

Mail To: Department of Revenue P.O. Box 23075 Jackson, MS 39225-3075

1

1 2

2