Form Wv/otp-7o1 - Tobacco Products Tax Report - 2001

ADVERTISEMENT

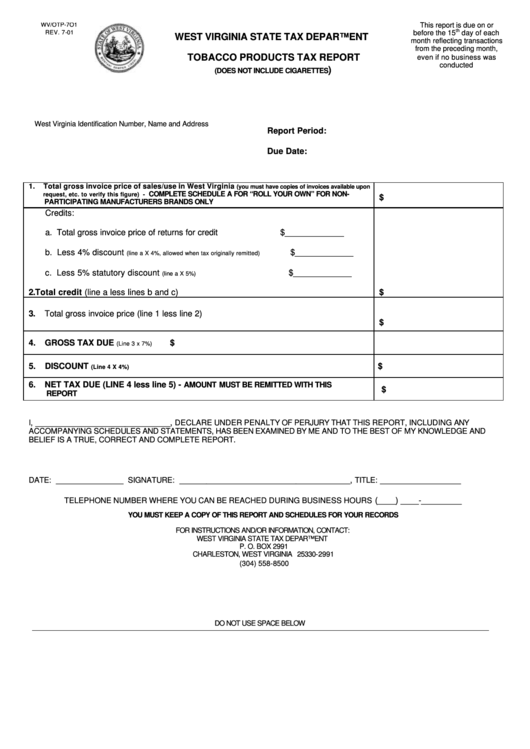

WV/OTP-7O1

This report is due on or

th

REV. 7-01

before the 15

day of each

WEST VIRGINIA STATE TAX DEPARTMENT

month reflecting transactions

from the preceding month,

TOBACCO PRODUCTS TAX REPORT

even if no business was

conducted

)

(DOES NOT INCLUDE CIGARETTES

West Virginia Identification Number, Name and Address

Report Period:

Due Date:

1.

Total gross invoice price of sales/use in West Virginia

(you must have copies of invoices available upon

COMPLETE SCHEDULE A FOR “ROLL YOUR OWN” FOR NON-

request, etc. to verify this figure) -

$

PARTICIPATING MANUFACTURERS BRANDS ONLY

Credits:

a. Total gross invoice price of returns for credit

$_____________

b. Less 4% discount

$_____________

(line a X 4%, allowed when tax originally remitted)

c. Less 5% statutory discount

$_____________

(line a X 5%)

2.

Total credit (line a less lines b and c)

$

3.

Total gross invoice price (line 1 less line 2)

$

4.

GROSS TAX DUE

$

(Line 3 x 7%)

5.

DISCOUNT

$

(Line 4 X 4%)

6.

NET TAX DUE (LINE 4 less line 5) -

AMOUNT MUST BE REMITTED WITH THIS

$

REPORT

______________________________,

I,

DECLARE UNDER PENALTY OF PERJURY THAT THIS REPORT, INCLUDING ANY

ACCOMPANYING SCHEDULES AND STATEMENTS, HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND

BELIEF IS A TRUE, CORRECT AND COMPLETE REPORT.

_______________

______________________________________,

__________________

DATE:

SIGNATURE:

TITLE:

(____) ____-_________

TELEPHONE NUMBER WHERE YOU CAN BE REACHED DURING BUSINESS HOURS

YOU MUST KEEP A COPY OF THIS REPORT AND SCHEDULES FOR YOUR RECORDS

FOR INSTRUCTIONS AND/OR INFORMATION, CONTACT:

WEST VIRGINIA STATE TAX DEPARTMENT

P. O. BOX 2991

CHARLESTON, WEST VIRGINIA 25330-2991

(304) 558-8500

DO NOT USE SPACE BELOW

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1