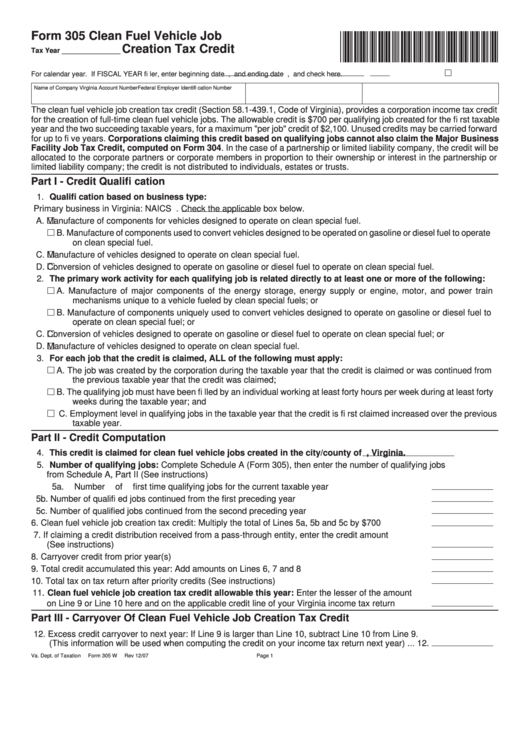

Form 305 - Clean Fuel Vehicle Job Creation Tax Credit - 2007

ADVERTISEMENT

Form 305

Clean Fuel Vehicle Job

Creation Tax Credit

Tax Year _______________

For calendar year. If FISCAL YEAR fi ler, enter beginning date

,

and ending date

,

and check here.

Name of Company

Virginia Account Number

Federal Employer Identifi cation Number

The clean fuel vehicle job creation tax credit (Section 58.1-439.1, Code of Virginia), provides a corporation income tax credit

for the creation of full-time clean fuel vehicle jobs. The allowable credit is $700 per qualifying job created for the fi rst taxable

year and the two succeeding taxable years, for a maximum "per job" credit of $2,100. Unused credits may be carried forward

for up to fi ve years. Corporations claiming this credit based on qualifying jobs cannot also claim the Major Business

Facility Job Tax Credit, computed on Form 304. In the case of a partnership or limited liability company, the credit will be

allocated to the corporate partners or corporate members in proportion to their ownership or interest in the partnership or

limited liability company; the credit is not distributed to individuals, estates or trusts.

Part I - Credit Qualifi cation

1. Qualifi cation based on business type:

Primary business in Virginia: NAICS

. Check the applicable box below.

A. Manufacture of components for vehicles designed to operate on clean special fuel.

B. Manufacture of components used to convert vehicles designed to be operated on gasoline or diesel fuel to operate

on clean special fuel.

C. Manufacture of vehicles designed to operate on clean special fuel.

D. Conversion of vehicles designed to operate on gasoline or diesel fuel to operate on clean special fuel.

2. The primary work activity for each qualifying job is related directly to at least one or more of the following:

A. Manufacture of major components of the energy storage, energy supply or engine, motor, and power train

mechanisms unique to a vehicle fueled by clean special fuels; or

B. Manufacture of components uniquely used to convert vehicles designed to operate on gasoline or diesel fuel to

operate on clean special fuel; or

C. Conversion of vehicles designed to operate on gasoline or diesel fuel to operate on clean special fuel; or

D. Manufacture of vehicles designed to operate on clean special fuel.

3. For each job that the credit is claimed, ALL of the following must apply:

A. The job was created by the corporation during the taxable year that the credit is claimed or was continued from

the previous taxable year that the credit was claimed;

B. The qualifying job must have been fi lled by an individual working at least forty hours per week during at least forty

weeks during the taxable year; and

C. Employment level in qualifying jobs in the taxable year that the credit is fi rst claimed increased over the previous

taxable year.

Part II - Credit Computation

4. This credit is claimed for clean fuel vehicle jobs created in the city/county of

, Virginia.

5. Number of qualifying jobs: Complete Schedule A (Form 305), then enter the number of qualifying jobs

from Schedule A, Part II (See instructions)

5a. Number of fi rst time qualifying jobs for the current taxable year ...............................................5a.

5b. Number of qualifi ed jobs continued from the fi rst preceding year .............................................5b.

5c. Number of qualifi ed jobs continued from the second preceding year ........................................5c.

6. Clean fuel vehicle job creation tax credit: Multiply the total of Lines 5a, 5b and 5c by $700 .............6.

7. If claiming a credit distribution received from a pass-through entity, enter the credit amount

(See instructions) ...............................................................................................................................7.

8. Carryover credit from prior year(s) .....................................................................................................8.

9. Total credit accumulated this year: Add amounts on Lines 6, 7 and 8 ...............................................9.

10. Total tax on tax return after priority credits (See instructions) ..........................................................10.

11. Clean fuel vehicle job creation tax credit allowable this year: Enter the lesser of the amount

on Line 9 or Line 10 here and on the applicable credit line of your Virginia income tax return ....... 11.

Part III - Carryover Of Clean Fuel Vehicle Job Creation Tax Credit

12. Excess credit carryover to next year: If Line 9 is larger than Line 10, subtract Line 10 from Line 9.

(This information will be used when computing the credit on your income tax return next year) ... 12.

Va. Dept. of Taxation

Form 305 W

Rev 12/07

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1