Instructions For Lafourche Parish Sales/use Tax Form

ADVERTISEMENT

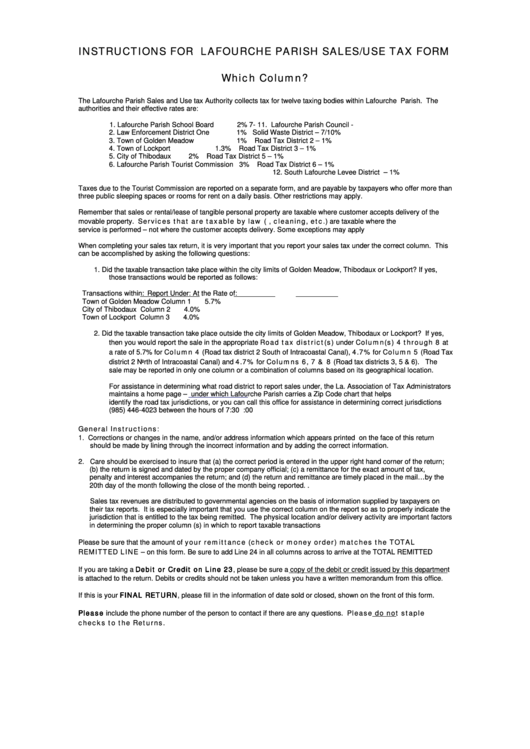

INSTRUCTIONS FOR LAFOURCHE PARISH SALES/USE TAX FORM

Which Column?

The Lafourche Parish Sales and Use tax Authority collects tax for twelve taxing bodies within Lafourche Parish. The

authorities and their effective rates are:

1.

Lafourche Parish School Board

2%

7- 11. Lafourche Parish Council -

2.

Law Enforcement District One

1%

Solid Waste District – 7/10%

3.

Town of Golden Meadow

1%

Road Tax District 2 – 1%

4.

Town of Lockport

1.3%

Road Tax District 3 – 1%

5.

City of Thibodaux

2%

Road Tax District 5 – 1%

6.

Lafourche Parish Tourist Commission 3%

Road Tax District 6 – 1%

12. South Lafourche Levee District – 1%

Taxes due to the Tourist Commission are reported on a separate form, and are payable by taxpayers who offer more than

three public sleeping spaces or rooms for rent on a daily basis. Other restrictions may apply.

Remember that sales or rental/lease of tangible personal property are taxable where customer accepts delivery of the

movable property. Services that are taxable by law (i.e. repairs, cleaning, etc.) are taxable where the

service is performed – not where the customer accepts delivery. Some exceptions may apply

When completing your sales tax return, it is very important that you report your sales tax under the correct column. This

can be accomplished by asking the following questions:

1.

Did the taxable transaction take place within the city limits of Golden Meadow, Thibodaux or Lockport? If yes,

those transactions would be reported as follows:

Transactions within:

Report Under:

At the Rate of:

Town of Golden Meadow

Column 1

5.7%

City of Thibodaux

Column 2

4.0%

Town of Lockport

Column 3

4.0%

2.

Did the taxable transaction take place outside the city limits of Golden Meadow, Thibodaux or Lockport? If yes,

then you would report the sale in the appropriate Road tax district(s) under Column(s) 4 through 8 at

a rate of 5.7% for Column 4 (Road tax district 2 South of Intracoastal Canal), 4.7% for Column 5 (Road Tax

district 2 North of Intracoastal Canal) and 4.7% for Columns 6, 7 & 8 (Road tax districts 3, 5 & 6). The

sale may be reported in only one column or a combination of columns based on its geographical location.

For assistance in determining what road district to report sales under, the La. Association of Tax Administrators

maintains a home page –

under which Lafourche Parish carries a Zip Code chart that helps

identify the road tax jurisdictions, or you can call this office for assistance in determining correct jurisdictions

(985) 446-4023 between the hours of 7:30 a.m. and 4:00 p.m.

General Instructions:

1. Corrections or changes in the name, and/or address information which appears printed on the face of this return

should be made by lining through the incorrect information and by adding the correct information.

2. Care should be exercised to insure that (a) the correct period is entered in the upper right hand corner of the return;

(b) the return is signed and dated by the proper company official; (c) a remittance for the exact amount of tax,

penalty and interest accompanies the return; and (d) the return and remittance are timely placed in the mail…by the

20th day of the month following the close of the month being reported. .

Sales tax revenues are distributed to governmental agencies on the basis of information supplied by taxpayers on

their tax reports. It is especially important that you use the correct column on the report so as to properly indicate the

jurisdiction that is entitled to the tax being remitted. The physical location and/or delivery activity are important factors

in determining the proper column (s) in which to report taxable transactions

Please be sure that the amount of your remittance (check or money order) matches the TOTAL

REMITTED LINE – on this form. Be sure to add Line 24 in all columns across to arrive at the TOTAL REMITTED

If you are taking a Debit or Credit on Line 23, please be sure a copy of the debit or credit issued by this department

is attached to the return. Debits or credits should not be taken unless you have a written memorandum from this office.

If this is your FINAL RETURN, please fill in the information of date sold or closed, shown on the front of this form.

Please include the phone number of the person to contact if there are any questions. Please do not staple

checks to the Returns.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2