Form Deed-13 - Report To Determine Liability For Unemployment Tax - Non-Profit - 2003

ADVERTISEMENT

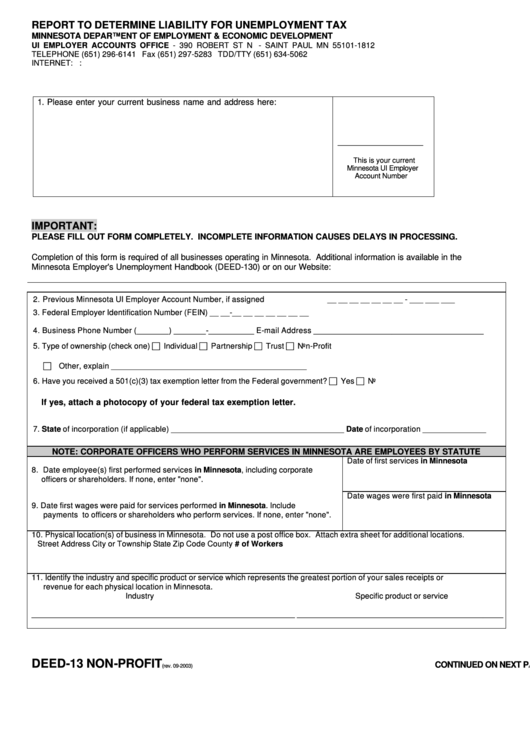

REPORT TO DETERMINE LIABILITY FOR UNEMPLOYMENT TAX

MINNESOTA DEPARTMENT OF EMPLOYMENT & ECONOMIC DEVELOPMENT

UI EMPLOYER ACCOUNTS OFFICE - 390 ROBERT ST N - SAINT PAUL MN 55101-1812

TELEPHONE (651) 296-6141 Fax (651) 297-5283 TDD/TTY (651) 634-5062

INTERNET:

-

E-MAIL: deed.tax.liability@state.mn.us

1. Please enter your current business name and address here:

___________________

This is your current

Minnesota UI Employer

Account Number

IMPORTANT:

PLEASE FILL OUT FORM COMPLETELY. INCOMPLETE INFORMATION CAUSES DELAYS IN PROCESSING.

Completion of this form is required of all businesses operating in Minnesota. Additional information is available in the

Minnesota Employer's Unemployment Handbook (DEED-130) or on our Website:

2. Previous Minnesota UI Employer Account Number, if assigned

__ __ __ __ __ __ __ - ___ ___ ___

3. Federal Employer Identification Number (FEIN) __ __-__ __ __ __ __ __ __

4. Business Phone Number (_______) _______-__________

E-mail Address ________________________________________

� Individual

� Partnership

� Trust

� Non-Profit

5. Type of ownership (check one)

� Other, explain ___________________________________________

� Yes

� No

6. Have you received a 501(c)(3) tax exemption letter from the Federal government?

If yes, attach a photocopy of your federal tax exemption letter.

7. State of incorporation (if applicable) ______________________________________ Date of incorporation ______________

NOTE: CORPORATE OFFICERS WHO PERFORM SERVICES IN MINNESOTA ARE EMPLOYEES BY STATUTE

Date of first services in Minnesota

8. Date employee(s) first performed services in Minnesota, including corporate

officers or shareholders. If none, enter "none".

Date wages were first paid in Minnesota

9. Date first wages were paid for services performed in Minnesota. Include

payments to officers or shareholders who perform services. If none, enter "none".

10. Physical location(s) of business in Minnesota. Do not use a post office box. Attach extra sheet for additional locations.

Street Address

City or Township

State

Zip Code

County

# of Workers

11. Identify the industry and specific product or service which represents the greatest portion of your sales receipts or

revenue for each physical location in Minnesota.

Industry

Specific product or service

__________________________________________________________ ______________________________________________

DEED-13 NON-PROFIT

CONTINUED ON NEXT PAGE

(rev. 09-2003)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2