Form Pa-8879 - Pennsylvania E-File Signature Authorization - 2004

ADVERTISEMENT

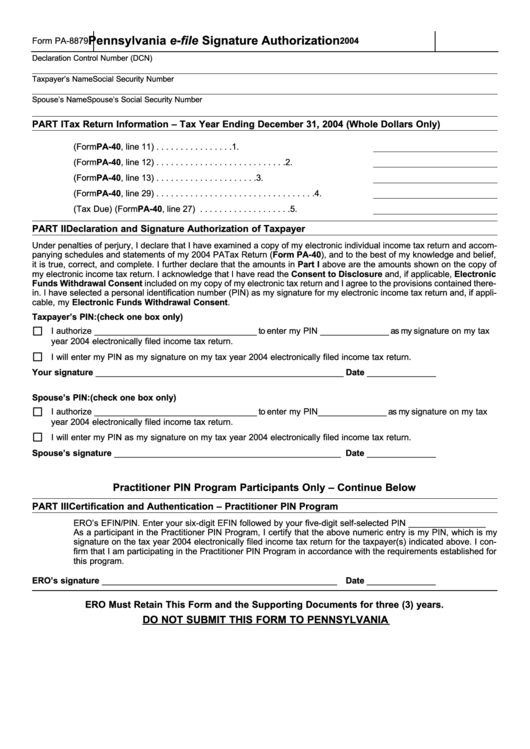

Pennsylvania e-file Signature Authorization

Form PA-8879

2004

Declaration Control Number (DCN)

Taxpayer’s Name

Social Security Number

Spouse’s Name

Spouse’s Social Security Number

PART I Tax Return Information – Tax Year Ending December 31, 2004 (Whole Dollars Only)

1. Adjusted PA Taxable Income (Form PA-40, line 11) . . . . . . . . . . . . . . . .1.

2. PA Tax Liability (Form PA-40, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . .2.

3. Total PA Tax Withheld (Form PA-40, line 13) . . . . . . . . . . . . . . . . . . . . .3.

4. Refund (Form PA-40, line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4.

5. Total Payment (Tax Due) (Form PA-40, line 27) . . . . . . . . . . . . . . . . . . .5.

PART II Declaration and Signature Authorization of Taxpayer

Under penalties of perjury, I declare that I have examined a copy of my electronic individual income tax return and accom-

panying schedules and statements of my 2004 PA Tax Return (Form PA-40), and to the best of my knowledge and belief,

it is true, correct, and complete. I further declare that the amounts in Part I above are the amounts shown on the copy of

my electronic income tax return. I acknowledge that I have read the Consent to Disclosure and, if applicable, Electronic

Funds Withdrawal Consent included on my copy of my electronic tax return and I agree to the provisions contained there-

in. I have selected a personal identification number (PIN) as my signature for my electronic income tax return and, if appli-

cable, my Electronic Funds Withdrawal Consent.

Taxpayer’s PIN:

(check one box only)

I authorize ______________________________________ to enter my PIN ________________ as my signature on my tax

year 2004 electronically filed income tax return.

I will enter my PIN as my signature on my tax year 2004 electronically filed income tax return.

Your signature __________________________________________________________ Date ________________

Spouse’s PIN:

(check one box only)

I authorize ______________________________________ to enter my PIN ________________ as my signature on my tax

year 2004 electronically filed income tax return.

I will enter my PIN as my signature on my tax year 2004 electronically filed income tax return.

Spouse’s signature _____________________________________________________ Date ________________

Practitioner PIN Program Participants Only – Continue Below

PART III Certification and Authentication – Practitioner PIN Program

ERO’s EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN __________________

As a participant in the Practitioner PIN Program, I certify that the above numeric entry is my PIN, which is my

signature on the tax year 2004 electronically filed income tax return for the taxpayer(s) indicated above. I con-

firm that I am participating in the Practitioner PIN Program in accordance with the requirements established for

this program.

ERO’s signature _______________________________________________________ Date ________________

ERO Must Retain This Form and the Supporting Documents for three (3) years.

DO NOT SUBMIT THIS FORM TO PENNSYLVANIA

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1