Rehabilitation Of Historic Properties Credit - Worksheet For Property Placed In Service During Tax Year Beginning In 2010 - Maine Revenue Services

ADVERTISEMENT

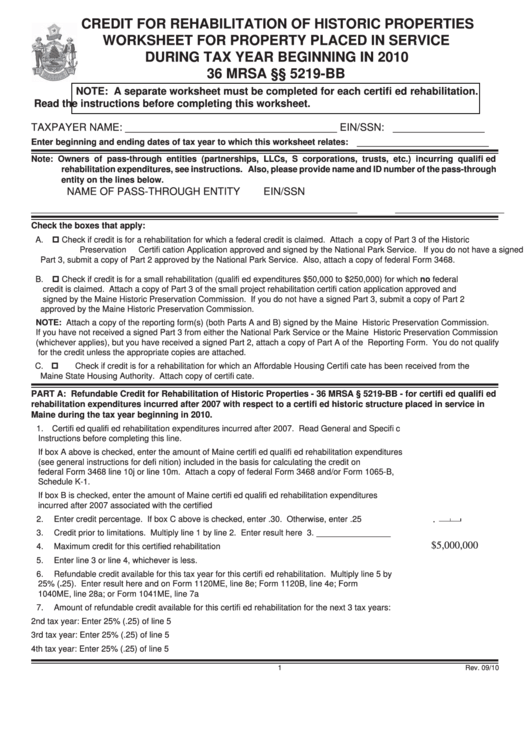

CREDIT FOR REHABILITATION OF HISTORIC PROPERTIES

WORKSHEET FOR PROPERTY PLACED IN SERVICE

DURING TAX YEAR BEGINNING IN 2010

36 MRSA §§ 5219-BB

NOTE: A separate worksheet must be completed for each certifi ed rehabilitation.

Read the instructions before completing this worksheet.

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

_______________________

Enter beginning and ending dates of tax year to which this worksheet relates:

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) incurring qualifi ed

rehabilitation expenditures, see instructions. Also, please provide name and ID number of the pass-through

entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

_________________________________________________________

___________________

Check the boxes that apply:

A.

Check if credit is for a rehabilitation for which a federal credit is claimed. Attach a copy of Part 3 of the Historic

Preservation Certifi cation Application approved and signed by the National Park Service. If you do not have a signed

Part 3, submit a copy of Part 2 approved by the National Park Service. Also, attach a copy of federal Form 3468.

B.

Check if credit is for a small rehabilitation (qualifi ed expenditures $50,000 to $250,000) for which no federal

credit is claimed. Attach a copy of Part 3 of the small project rehabilitation certifi cation application approved and

signed by the Maine Historic Preservation Commission. If you do not have a signed Part 3, submit a copy of Part 2

approved by the Maine Historic Preservation Commission.

NOTE: Attach a copy of the reporting form(s) (both Parts A and B) signed by the Maine Historic Preservation Commission.

If you have not received a signed Part 3 from either the National Park Service or the Maine Historic Preservation Commission

(whichever applies), but you have received a signed Part 2, attach a copy of Part A of the Reporting Form. You do not qualify

for the credit unless the appropriate copies are attached.

C.

Check if credit is for a rehabilitation for which an Affordable Housing Certifi cate has been received from the

Maine State Housing Authority. Attach copy of certifi cate.

PART A: Refundable Credit for Rehabilitation of Historic Properties - 36 MRSA § 5219-BB - for certifi ed qualifi ed

rehabilitation expenditures incurred after 2007 with respect to a certifi ed historic structure placed in service in

Maine during the tax year beginning in 2010.

1. Certifi ed qualifi ed rehabilitation expenditures incurred after 2007. Read General and Specifi c

Instructions before completing this line.

If box A above is checked, enter the amount of Maine certifi ed qualifi ed rehabilitation expenditures

(see general instructions for defi nition) included in the basis for calculating the credit on

federal Form 3468 line 10j or line 10m. Attach a copy of federal Form 3468 and/or Form 1065-B,

Schedule K-1.

If box B is checked, enter the amount of Maine certifi ed qualifi ed rehabilitation expenditures

incurred after 2007 associated with the certifi ed rehabilitation..............................................................1. ________________

2. Enter credit percentage. If box C above is checked, enter .30. Otherwise, enter .25 .........................2.

.

3. Credit prior to limitations. Multiply line 1 by line 2. Enter result here ...................................................3. ________________

$5,000,000

4. Maximum credit for this certifi ed rehabilitation ......................................................................................4. ________________

5. Enter line 3 or line 4, whichever is less. ................................................................................................5. ________________

6. Refundable credit available for this tax year for this certifi ed rehabilitation. Multiply line 5 by

25% (.25). Enter result here and on Form 1120ME, line 8e; Form 1120B, line 4e; Form

1040ME, line 28a; or Form 1041ME, line 7a .........................................................................................6. ________________

7. Amount of refundable credit available for this certifi ed rehabilitation for the next 3 tax years:

2nd tax year: Enter 25% (.25) of line 5 .................................................................

7a. ________________

3rd tax year:

Enter 25% (.25) of line 5 .................................................................

7b. ________________

4th tax year:

Enter 25% (.25) of line 5 .................................................................

7c. ________________

1

Rev. 09/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2