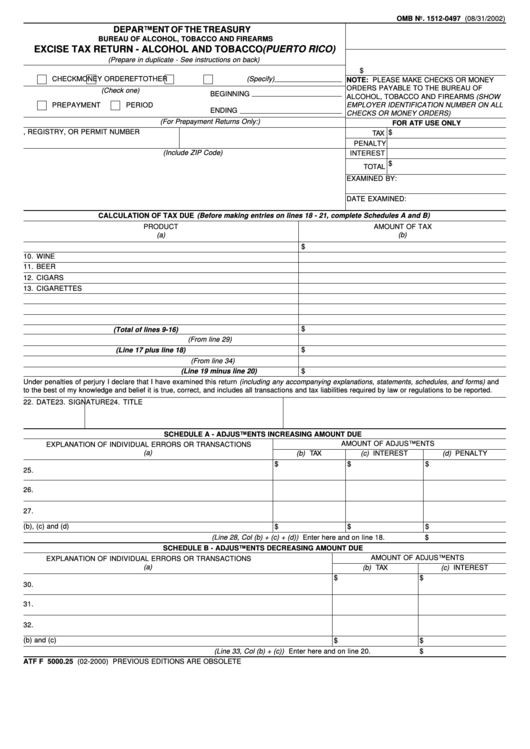

Form Atf F 5000.25 - Excise Tax Return - Alcohol And Tobacco (Puerto Rico)

ADVERTISEMENT

OMB No. 1512-0497 (08/31/2002)

1. SERIAL NUMBER

DEPARTMENT OF THE TREASURY

BUREAU OF ALCOHOL, TOBACCO AND FIREARMS

EXCISE TAX RETURN - ALCOHOL AND TOBACCO (PUERTO RICO)

3. AMOUNT OF PAYMENT

(Prepare in duplicate - See instructions on back)

2. FORM OF PAYMENT

$

OTHER (Specify)

CHECK

MONEY ORDER

EFT

NOTE: PLEASE MAKE CHECKS OR MONEY

ORDERS PAYABLE TO THE BUREAU OF

4. RETURN COVERS (Check one)

BEGINNING

ALCOHOL, TOBACCO AND FIREARMS (SHOW

PREPAYMENT

PERIOD

EMPLOYER IDENTIFICATION NUMBER ON ALL

ENDING

CHECKS OR MONEY ORDERS)

5. DATE PRODUCTS TO BE REMOVED (For Prepayment Returns Only:)

FOR ATF USE ONLY

6. EMPLOYER IDENTIFICATION NUMBER

7. PLANT, REGISTRY, OR PERMIT NUMBER

$

TAX

PENALTY

8. NAME AND ADDRESS OF TAXPAYER (Include ZIP Code)

INTEREST

$

TOTAL

EXAMINED BY:

DATE EXAMINED:

CALCULATION OF TAX DUE (Before making entries on lines 18 - 21, complete Schedules A and B)

AMOUNT OF TAX

PRODUCT

(a)

(b)

9. DISTILLED SPIRITS

$

10. WINE

11. BEER

12. CIGARS

13. CIGARETTES

14. CIGARETTE PAPERS AND/OR CIGARETTE TUBES

15. CHEWING TOBACCO AND/OR SNUFF

16. PIPE TOBACCO AND/OR ROLL-YOUR-OWN TOBACCO

$

17. TOTAL TAX LIABILITY (Total of lines 9-16)

18. ADJUSTMENTS INCREASING AMOUNT DUE (From line 29)

19. GROSS AMOUNT DUE (Line 17 plus line 18)

$

20. ADJUSTMENTS DECREASING AMOUNT DUE (From line 34)

21. AMOUNT TO BE PAID WITH THIS RETURN (Line 19 minus line 20)

$

Under penalties of perjury I declare that I have examined this return (including any accompanying explanations, statements, schedules, and forms) and

to the best of my knowledge and belief it is true, correct, and includes all transactions and tax liabilities required by law or regulations to be reported.

22. DATE

23. SIGNATURE

24. TITLE

SCHEDULE A - ADJUSTMENTS INCREASING AMOUNT DUE

AMOUNT OF ADJUSTMENTS

EXPLANATION OF INDIVIDUAL ERRORS OR TRANSACTIONS

(a)

(b) TAX

(c) INTEREST

(d) PENALTY

$

$

$

25.

26.

27.

28. SUBTOTALS OF COLUMNS (b), (c) and (d)

$

$

$

29. TOTAL ADJUSTMENTS INCREASING AMOUNT DUE (Line 28, Col (b) + (c) + (d)) Enter here and on line 18.

$

SCHEDULE B - ADJUSTMENTS DECREASING AMOUNT DUE

AMOUNT OF ADJUSTMENTS

EXPLANATION OF INDIVIDUAL ERRORS OR TRANSACTIONS

(a)

(b) TAX

(c) INTEREST

$

$

30.

31.

32.

33. SUBTOTALS OF COLUMNS (b) and (c)

$

$

34. TOTAL ADJUSTMENTS DECREASING AMOUNT DUE (Line 33, Col (b) + (c)) Enter here and on line 20.

$

ATF F 5000.25 (02-2000) PREVIOUS EDITIONS ARE OBSOLETE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2