Clear Form

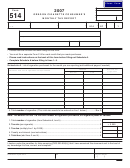

2010

Revenue use only

Form

Date received

514

•

Oregon Cigarette Consumer’s

Payment received

Monthly Tax Report

•

Reporting period

Social Security number (SSN)

Oregon business identification number (BIN) (only for businesses) Program code

Year

Period

Liability

•

•

•

•

•

•

514

10

1

Month:

Name

Mailing address

City

State

ZIP code

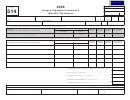

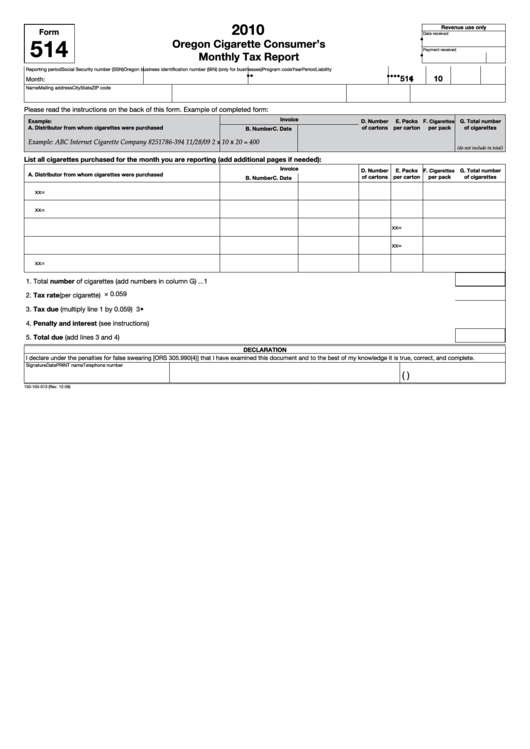

Please read the instructions on the back of this form. Example of completed form:

Invoice

Example:

D. Number

E. Packs

F.

G. Total number

Cigarettes

A. Distributor from whom cigarettes were purchased

of cartons

per carton

per pack

of cigarettes

B. Number

C. Date

Example: ABC Internet Cigarette Company

8251786-394

11/28/09

2

10

x

20

400

x

=

(do not include in total)

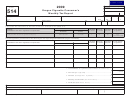

List all cigarettes purchased for the month you are reporting (add additional pages if needed):

Invoice

D. Number

E. Packs

F.

G. Total number

Cigarettes

A. Distributor from whom cigarettes were purchased

of cartons

per carton

per pack

of cigarettes

B. Number

C. Date

x

x

=

x

x

=

x

x

=

x

x

=

x

x

=

1. Total number of cigarettes (add numbers in column G) ... 1

× 0.059

2. Tax rate (per cigarette) ..................................................... 2

3. Tax due (multiply line 1 by 0.059) ..................................... 3•

4. Penalty and interest (see instructions) ............................ 4

5. Total due (add lines 3 and 4) ............................................ 5

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best of my knowledge it is true, correct, and complete.

Signature

PRINT name

Date

Telephone number

(

)

150-105-013 (Rev. 12-09)

1

1