Schedule 5930h-B - Credits For Current And Carry Forward To Subsequent Years - 2004

ADVERTISEMENT

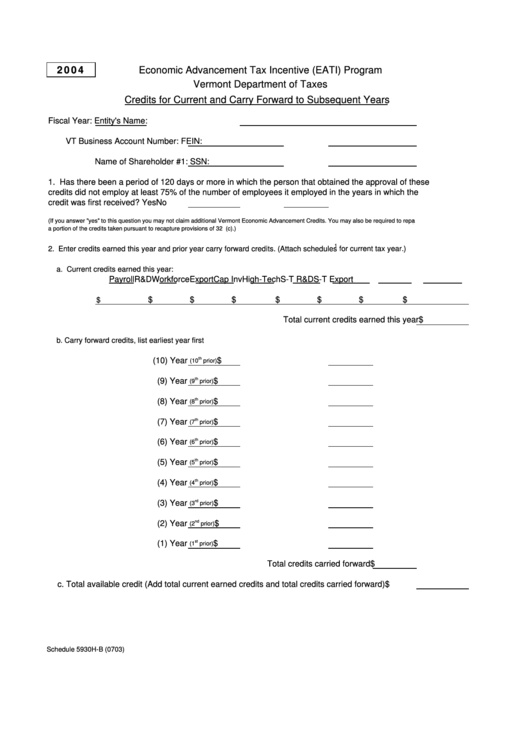

2004

Economic Advancement Tax Incentive (EATI) Program

Vermont Department of Taxes

Credits for Current and Carry Forward to Subsequent Years

Fiscal Year:

Entity's Name:

VT Business Account Number:

FEIN:

Name of Shareholder #1:

SSN:

1. Has there been a period of 120 days or more in which the person that obtained the approval of these

credits did not employ at least 75% of the number of employees it employed in the years in which the

credit was first received?

Yes

No

(If you answer "yes" to this question you may not claim additional Vermont Economic Advancement Credits. You may also be required to repay

a portion of the credits taken pursuant to recapture provisions of 32 V.S.A. 5930h(c).)

1

2. Enter credits earned this year and prior year carry forward credits. (Attach schedules

for current tax year.)

a. Current credits earned this year:

Payroll

R&D

Workforce

Export

Cap Inv

High-Tech S-T R&D

S-T Export

$

$

$

$

$

$

$

$

Total current credits earned this year$

b. Carry forward credits, list earliest year first

(10) Year

th

$

(10

prior)

th

(9) Year

$

(9

prior)

th

(8) Year

$

(8

prior)

th

(7) Year

$

(7

prior)

th

(6) Year

$

(6

prior)

th

(5) Year

$

(5

prior)

th

(4) Year

$

(4

prior)

(3) Year

rd

$

(3

prior)

nd

(2) Year

$

(2

prior)

st

(1) Year

$

(1

prior)

Total credits carried forward $

c. Total available credit (Add total current earned credits and total credits carried forward)

$

Schedule 5930H-B (0703)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3