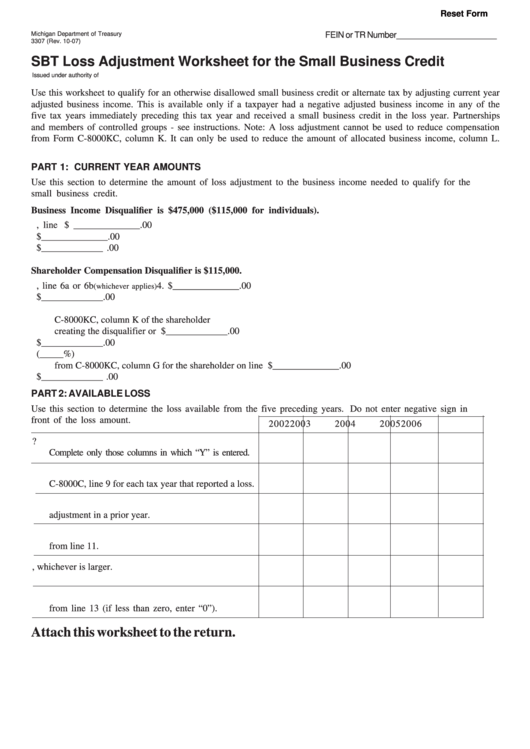

Reset Form

Michigan Department of Treasury

FEIN or TR Number______________________

3307 (Rev. 10-07)

SBT Loss Adjustment Worksheet for the Small Business Credit

Issued under authority of P.A. 257 of 1990.

Use this worksheet to qualify for an otherwise disallowed small business credit or alternate tax by adjusting current year

adjusted business income. This is available only if a taxpayer had a negative adjusted business income in any of the

five tax years immediately preceding this tax year and received a small business credit in the loss year. Partnerships

and members of controlled groups - see instructions. Note: A loss adjustment cannot be used to reduce compensation

from Form C-8000KC, column K. It can only be used to reduce the amount of allocated business income, column L.

PART 1: CURRENT YEAR AMOUNTS

Use this section to determine the amount of loss adjustment to the business income needed to qualify for the

small business credit.

Business Income Disqualifier is $475,000 ($115,000 for individuals).

1.

Adjusted Business Income from C-8000C, line 9 ..................... 1. $ ______________ .00

2.

Less the disqualifier ........................................................................ 2. $ ______________ .00

3.

Loss adjustment. Subtract line 2 from line 1 ............................................................. 3. $ _____________ .00

Shareholder Compensation Disqualifier is $115,000.

4.

Enter the amount from C-8000C, line 6a or 6b

4. $ ______________ .00

(whichever applies)

5.

Disqualifier ..................................................... 5. $ _____________ .00

6.

Enter compensation and director fees from

C-8000KC, column K of the shareholder

creating the disqualifier or reduction ................ 6. $ _____________ .00

7.

Subtract line 6 from line 5 ................................ 7. $ _____________ .00

8.

Divide line 7 by the percent of ownership (_____%)

from C-8000KC, column G for the shareholder on line 6 .............. 8. $ ______________ .00

9.

Loss adjustment. Subtract line 8 from line 4 .................................................................. 9. $ _____________ .00

PART 2: AVAILABLE LOSS

Use this section to determine the loss available from the five preceding years. Do not enter negative sign in

front of the loss amount.

2002

2003

2004

2005

2006

10. Did taxpayer receive a small business credit?

Complete only those columns in which “Y” is entered.

11. Enter adjusted business income as reported on

C-8000C, line 9 for each tax year that reported a loss.

12. Amount of loss entered on line 11 used as an

adjustment in a prior year.

13. Loss available for current return. Subtract line 12

from line 11.

14. Enter the amount from line 3 or 9, whichever is larger.

15. Loss available for future returns. Subtract line 14

from line 13 (if less than zero, enter “0”).

Attach this worksheet to the return.

1

1